Introduction

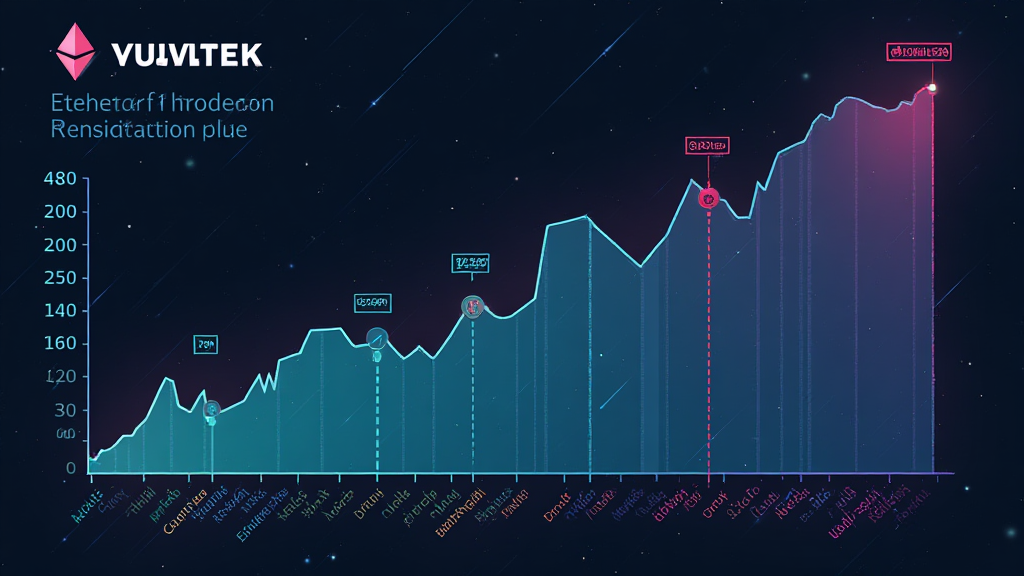

As we look towards the future of cryptocurrency, the anticipated Ethereum price target for 2026 comes into sharper focus. With a booming market and institutional interest on the rise, many investors are keen to know what lies ahead for Ethereum. In 2024 alone, decentralized finance (DeFi) hacks led to a staggering $4.1 billion in losses. This highlights the importance of understanding Ethereum‘s potential as we approach the next bull run.

This article aims to delve deep into the factors influencing Ethereum‘s price, the projected target for 2026, and strategies for both seasoned investors and newcomers. By grasping these elements, you can better navigate the volatile waters of cryptocurrency investments.

Understanding Ethereum‘s Value Proposition

Ethereum, often dubbed the backbone of decentralized applications, offers unique capabilities compared to other cryptocurrencies. Here’s why it’s central to the blockchain ecosystem:

- Smart Contracts: Automated contracts that execute once conditions are met, minimizing the risk of fraud.

- Decentralized Finance: Ethereum powers many DeFi applications, bringing financial services to those without access to traditional banking.

- Non-Fungible Tokens (NFTs): The platform hosts a majority of NFT marketplaces, ensuring ownership and authenticity in the digital world.

According to recent data, Ethereum‘s market dominance has been a stable 18% despite the influx of new tokens. In Vietnam, blockchain technology is gaining traction, with user growth rates skyrocketing 200% annually, further solidifying Ethereum‘s relevance in global markets.

Factors Influencing Ethereum Price

Market Sentiment and Adoption Rates

Market sentiment often drives the price of cryptocurrencies. Positive news cycles can lead to bullish trends and vice versa. For Ethereum, increasing adoption in various sectors, including finance, gaming, and supply chain, becomes a critical driver of its price. The platform’s upgrades, like moving to Proof of Stake, enhance scalability and reduce gas fees, attracting more users.

Regulatory Landscape

The regulatory environment for cryptocurrencies is ever-evolving and can significantly influence prices. In Vietnam, regulatory clarity is emerging, which will attract more institutional investors and increase adoption. In 2026, the clarity in regulations will likely ease many concerns surrounding cryptocurrency investments.

Technological Advances

Ethereum developers are consistently improving the network. Innovations such as sharding and layer-2 solutions will play a critical role in handling increased demand as the user base expands. For instance, a recent upgrade proposal aims to enhance transaction speeds significantly, potentially doubling throughput.

Insights into the 2026 Bull Run

As we foresee a bull run in 2026, understanding how to position yourself becomes essential. The following strategies can provide necessary insights:

- Long-Term Holding vs. Trading: Decide whether to hold Ethereum long-term or engage in trading for short-term profits.

- Diversifying Your Portfolio: It’s wise to include a mix of cryptocurrencies. Explore promising altcoins alongside Ethereum, like Cardano or Solana.

- Staying Informed: Continuous learning about blockchain technology and market trends is crucial. Attend webinars, subscribe to industry newsletters, and participate in community discussions.

In 2025, many analysts project Ethereum could surpass the $10,000 mark. Market capitalization is expected to hit $2 trillion, marking a significant rise from previous years.

Conclusion

In conclusion, forecasting Ethereum‘s price target for 2026 during the bull run is a complex but essential endeavor for investors. Understanding the many factors that influence Ethereum’s value can help make informed decisions. Given the rapid advancements in both technology and market sentiment, it is reasonable to expect Ethereum to not only maintain its place in the cryptocurrency ecosystem but to surge ahead as a leader.

With increasing investments in blockchain technology and the growing Vietnamese market, now is the perfect time to explore your options within the crypto space.

To stay updated on Ethereum and other cryptocurrencies, consider leveraging resources like hibt.com and follow market trends closely.

Not financial advice. Consult local regulators.

Author: Dr. Alex Tran

Dr. Tran is a renowned blockchain security expert with over 15 publications in the field and has led audits on several high-profile projects.