Venture Capital Crypto Investments: A Guide to Unlocking Future Potential

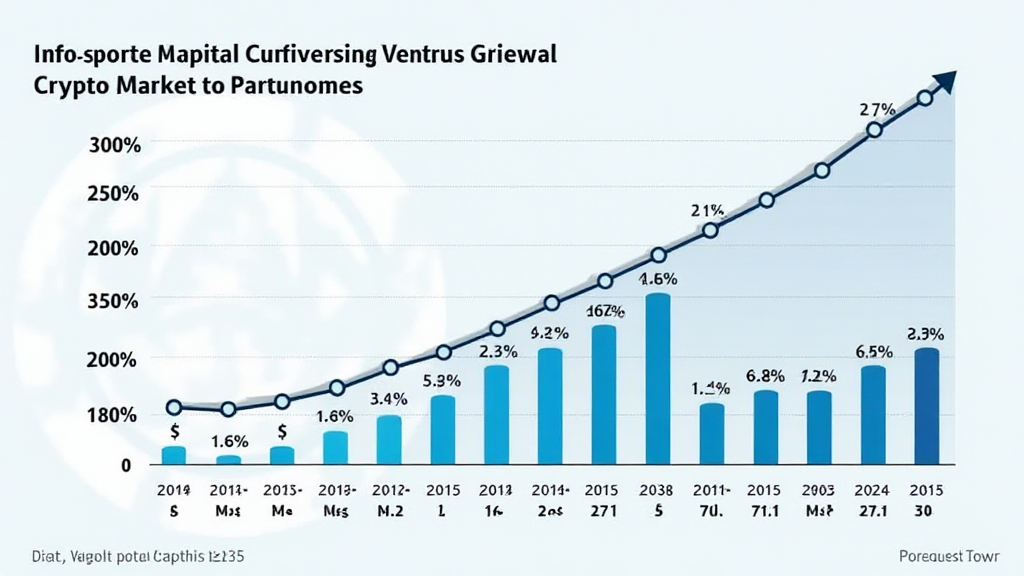

Join the revolution as venture capital rapidly transforms the cryptocurrency landscape. With estimates showing that under $2 billion of venture capital has gone into crypto investments in 2023, interest in this dynamic space is heating up. By 2025, predictions suggest significant growth as more investors seek to capitalize on blockchain innovations and digital asset opportunities.

Understanding the Landscape of Venture Capital in Crypto

Venture capital (VC) forms the backbone of many startup ecosystems, helping innovative companies to scale. Unlike traditional stocks, investments in cryptocurrencies often carry higher risks but offer lucrative rewards. For example, investing in altcoins has shown to yield returns exceeding 1000% in remarkable market conditions.

As tiêu chuẩn an ninh blockchain continues to evolve, venture capitalists are focusing on sectors within crypto that promise substantial returns:

- DeFi (Decentralized Finance)

- NFTs (Non-Fungible Tokens)

- Blockchain Tools and Infrastructure

- Web3 and Metaverse Projects

Key Trends Influencing Crypto Investments

In 2024 and beyond, several trends are expected to drive venture capital interest in the crypto landscape:

- Regulatory Clarity: Nationwide regulations will permeate the crypto space, allowing investors to feel secure.

- Institutional Adoption: Large corporations, including banks, are increasingly entering the crypto realm.

- Increased Accessibility: Platforms simplifying access to crypto investments will open the floodgates for retail investors.

- Technological Advancements: Innovations such as Layer-2 solutions are addressing blockchain scalability issues.

Evaluation Criteria for Venture Capital Opportunities

When looking at potential crypto investments, venture capitalists focus on certain critical factors:

- Team Experience: Assessing the background of the founding team offers insight into their ability to execute plans.

- Use Case Validation: The product must solve an existing problem within the market.

- Market Timing: Understanding prevailing trends is crucial in determining the right time to enter.

- Tokenomics: A well-structured economic model plays a key role in the sustainability of a project.

Risks Involved in Venture Capital Crypto Investments

Every investment carries risks, and crypto is no different. Here are the primary risks associated with venture capital in this sphere:

- Market Volatility: The crypto market is known for its extreme price fluctuations.

- Regulatory Risks: Continual changes in laws can affect projects unpredictably.

- Security Vulnerabilities: Hackings and breaches could lead to significant losses.

- Liquidity Risks: Certain tokens may not be easily tradable in a downturn.

Success Stories: Emerging Projects to Watch

As we advance rapidly toward 2025, some projects are emerging as top contenders:

- Ethereum 2.0: Enhancing scalability and sustainability, drawing significant VC interest.

- Polkadot: Linking various blockchains, offering unique interoperability solutions.

- QuickSwap: A decentralized exchange that showcases the future of trading.

With approximately UR: 35% growth in the Vietnamese crypto market over the last year, this environment presents prime opportunities for venture capitalists interested in crypto investments.

Effective Strategies for Venture Capitalists in Crypto

This rapidly evolving environment requires venture capitalists to adopt effective strategies:

- Diversification: Spreading investments across multiple sectors mitigates risks.

- Active Monitoring: Staying informed of market changes can enhance decision-making.

- Networking: Building relationships within the crypto community unlocks more investment opportunities.

- Due Diligence: Investigating projects thoroughly before committing funds is essential.

Remember that while investing in crypto presents opportunities, potential losses can be staggering. Always consult experts and analyze local regulations before diving into any investment.

Conclusion

The fusion of venture capital and crypto investments opens the door for innovative projects poised to redefine our financial systems. By understanding the landscape, evaluating promising opportunities, and adopting suitable strategies, investors can position themselves to thrive as we move toward 2025.

Looking ahead, venture capitalists must remain vigilant, informed, and adaptive to the shifting tides of the cryptocurrency market. Platforms like bitcryptodeposit provide invaluable insights into current trends and investment opportunities within the crypto ecosystem.

As market dynamics evolve, your participation in venture capital crypto investments could very well be the catalyst for growth in years to come. Ready to embark on your investment journey?

Author: John Smith

A financial analyst and crypto enthusiast with over 10 published papers in blockchain technology and experience leading audits on various projects in the blockchain space.