Bitcoin Halving Market Forecasts: What to Expect in 2025

With over $4.1 billion lost to decentralized finance (DeFi) hacks in 2024, the importance of understanding Bitcoin’s market dynamics becomes even more crucial. In this article, we delve into Bitcoin halving and what it means for the market forecasts in 2025. As the cryptocurrency landscape continues to evolve, keeping abreast of key events like halving is vital for investors and enthusiasts alike.

Understanding Bitcoin Halving

Bitcoin halving is a significant event where the reward miners receive for processing transactions is halved. Occurring approximately every four years, this mechanism serves to regulate Bitcoin’s supply and maintain its scarcity, leading to potential price increases. For those unfamiliar, here’s a simplified breakdown:

- Halvings occur approximately every 210,000 blocks.

- Initial reward was 50 BTC per block, cut to 25 BTC, then to 12.5 BTC, currently at 6.25 BTC.

- Next expected halving is in 2024, reducing the reward to 3.125 BTC.

This process helps ensure Bitcoin’s inflation rate decreases over time, making it increasingly valuable as demand grows.

Market Reactions to Previous Halvings

Let’s break down the past performance post-halvings:

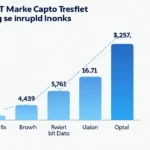

| Halving Date | Block Reward | Price 30 Days Prior | Price 30 Days After | Price One Year After |

|---|---|---|---|---|

| 2012 | 50 BTC to 25 BTC | $12 | $1,000 | $13,000 |

| 2016 | 25 BTC to 12.5 BTC | $450 | $2,525 | $20,000 |

| 2020 | 12.5 BTC to 6.25 BTC | $8,800 | $64,400 | $69,000 |

From the data, it’s clear that past halvings have historically triggered significant price surges. In 2021, Bitcoin achieved an all-time high just months after the 2020 halving.

Implications for 2025 Market Forecasts

Based on historical patterns, analysts predict that the upcoming 2024 halving will drive Bitcoin prices upwards. However, it is essential to take into account several market factors:

- Market Demand: Increased participation from retail and institutional investors could propel prices to new heights.

- Regulatory Changes: Emerging regulations, especially in markets like Vietnam, can alter investor behavior and market dynamics.

- International Adoption: As countries like Vietnam exhibit rapid growth in cryptocurrency adoption, the demand for Bitcoin is expected to rise significantly.

For instance, Vietnam reported a growth rate of over 50% among cryptocurrency users in 2023. This trend indicates a burgeoning interest that could affect global Bitcoin prices.

Analyzing the Current Market Conditions

As of now, factors influencing market conditions include:

- Global Economic Environment: With inflationary pressures in various economies, Bitcoin is increasingly regarded as a hedge against inflation.

- Technological Improvements: Innovations like the Lightning Network are enhancing Bitcoin’s scalability, making it more appealing to users.

- Cultural Shifts: The growing awareness and acceptance of cryptocurrencies can lead to more mainstream adoption.

These elements combined with past halving outcomes may suggest a bullish trend moving into 2025.

Preparing for Bitcoin’s Future: Strategies for Investors

Here are actionable strategies for crypto investors as we approach the halving:

- Diversify Investments: Consider allocating a portion of your portfolio to altcoins, approaching the potential of assets like Ethereum and emerging altcoins in 2025.

- Stay Informed: Keep an eye on regulatory updates and market shifts that may impact prices. Subscribing to reliable crypto news outlets is recommended.

- Utilize Technology: Implement wallets with high security standards, such as the Ledger Nano X, which can reduce the risk of hacks.

Incorporating these strategies will enable investors to navigate the complexities of Bitcoin’s market effectively.

Final Thoughts on Bitcoin Halving Market Forecasts

As we look towards 2025, Bitcoin halving remains a pivotal component of market dynamics. Understanding historical performance, current conditions, and emerging trends can empower investors and enthusiasts alike.

With careful research and strategic planning, investors can position themselves to take advantage of the opportunities that Bitcoin halving presents. As we approach this significant event, remember to conduct your own due diligence before making investment decisions.

For more insights and updates, you can visit hibt.com for expert analyses on market forecasts and investment strategies tailored to your needs.

Not financial advice. Consult local regulators and financial advisors for personal investment guidance.

This article is brought to you by a virtual expert with significant expertise in blockchain technology and market analysis, contributing to numerous publications in the field.