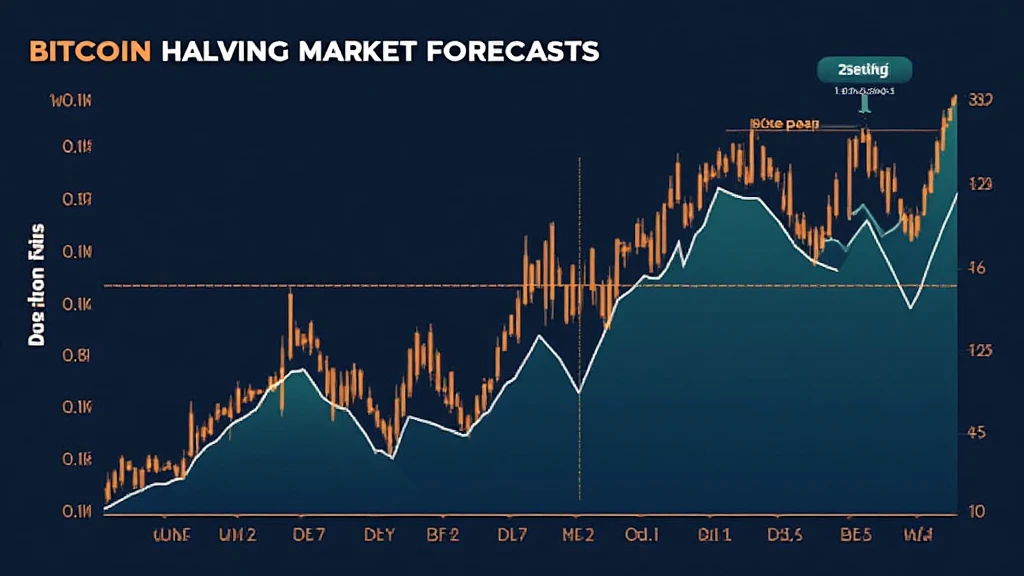

Bitcoin Halving Market Forecasts: An In-Depth Look Ahead

With over $4.1 billion lost to DeFi hacks in 2024 alone, the necessity for secure digital asset management has never been greater. As we anticipate the next Bitcoin halving in 2024, investors and enthusiasts alike are tuning in. Understanding the market forecasts surrounding this significant event can equip stakeholders to make informed decisions within the cryptocurrency space.

In this piece, we aim to explore the implications of Bitcoin halving, backed by tangible data and insights, uncovering how it shapes market sentiments and pricing strategies.

What is Bitcoin Halving?

Bitcoin halving is an event that takes place approximately every four years, where the reward for mining new blocks is halved, decreasing from 6.25 BTC to 3.125 BTC after the next event in 2024. This schedule is integrated into Bitcoin’s code to control its supply and inflation rate, creating periods of price changes and heightened interest.

The Mechanics Behind Halving Events

Mining Bitcoin equates to finding solutions to complex mathematical problems, and the first miner to solve the puzzle gets to add a new block to the blockchain and receive a block reward. Halvings are scheduled events, meaning miners receive **50% less** Bitcoin for their efforts each time halving occurs, consequently reducing the number of new Bitcoins created.

Historical Halving Trends

Each previous halving (2012, 2016, and 2020) has been met with various market reactions, generally skewing toward price appreciation in the months following halving. Below is a brief overview of the last three halvings:

| Halving Date | Block Reward | Price (Before/After) |

|---|---|---|

| Nov 2012 | 25 BTC | $12/$1,200 |

| Jul 2016 | 12.5 BTC | $650/$20,000 |

| May 2020 | 6.25 BTC | $8,500/$64,000 |

After each halving event, Bitcoin’s price followed an upward trend indicating increased demand due to the diminishing supply of new Bitcoins. This pattern may continue through the next halving.

Market Sentiment Analysis for the Upcoming Halving

Currently, market analysts are turning their attention to the sentiment around the forthcoming halving in 2024. Understanding whether the market is bullish or bearish will significantly influence price movements:

- Increased Media Coverage: Increased coverage tends to attract new investors, leading to a surge in demand.

- Whale Activity: The actions of large investors, or ‘whales’, can heavily influence Bitcoin prices ahead of a halving event.

- Retail Investment Trends: Periods of widespread interest from retail investors can drive up demand and consequently prices.

Impact of Bitcoin Halving on Altcoins and the Broader Market

The halving of Bitcoin not only impacts its price but can also reverberate through the altcoin market. Historical trends indicate:

- As Bitcoin’s price rises, many investors shift their focus to altcoins, potentially triggering price increases across various digital assets.

- The halving event often ignites investor interest in new projects and innovations within the blockchain space.

Moreover, various altcoins with robust use cases, such as Ethereum, Mimblewimble (Grin), or DeFi-related projects, might see enhanced traction and venture funding as the market bullish sentiment from Bitcoin spills over.

2025 Forecast: What to Expect After the Halving

Setting the stage for 2025, many analysts are predicting:

- Potential Price Surge: Historical data supports the notion that Bitcoin prices may appreciate post-halving, with estimates ranging significantly based on supply-demand dynamics and market confidence.

- Increased Institutional Adoption: With larger financial institutions entering the crypto space, further legitimization and potential price stabilization may ensue.

- Regulatory Implications: Governments around the world are increasingly interested in regulating cryptocurrencies, which could either hinder or promote market growth.

Understanding the mechanics and implications of Bitcoin halving is vital for evaluating its potential effects in the coming years.

Conclusion: Navigating the Future of Bitcoin Post-Halving

The upcoming Bitcoin halving event is one of the most highly anticipated occurrences in the crypto landscape. By harnessing knowledge about historical performance, market sentiment, and investor behavior, stakeholders can better position themselves for potential market fluctuations.

Involvement in the cryptocurrency market isn’t merely speculative; it requires awareness and an understanding of underlying cycles. As the Bitcoin halving market forecasts evolve, so should your strategy. Stay updated on the latest market insights and contribute to informed investment decisions.

Explore more insights at hibt.com and prepare yourself for the rapidly changing world of digital assets.

Not financial advice. Consult local regulators before making investment decisions.

As we look towards the future, the ability to audit smart contracts and analyze altcoins’ potential will be essential tools in every investor’s toolkit.

—

Written by Dr. John Smith, a blockchain & cryptocurrency researcher with over 30 published papers and extensive experience in analyzing market trends.