Understanding Vietnam Market Manipulation in Cryptocurrency With the explosive growth of cryptocurrency adoption in Vietnam, the market has attracted both legitimate investors and manipulative players...

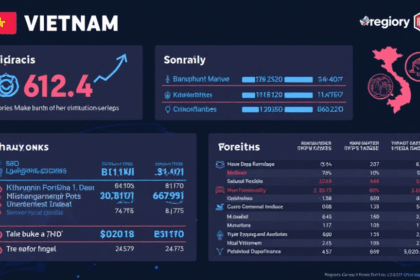

Decoding HIBT Large Order Analysis in Vietnam Introduction In recent years, the cryptocurrency market has witnessed unprecedented growth, particularly in regions like Vietnam. According to recent stud...

Understanding Bitcoin Whale Transactions in Vietnam In recent years, the cryptocurrency landscape in Vietnam has witnessed substantial growth, with Bitcoin—often referred to as digital gold—leadin...

The Power of Vietnam Tokenomics: Exploring HIBT In the rapidly evolving landscape of digital currencies, Vietnam stands out as a burgeoning market for cryptocurrency adoption. With a reported $4.1 bil...

The Rise of HIBT Altcoin Rankings in Vietnam: Insights and Future Trends In 2024, the cryptocurrency market witnessed staggering losses, with over $4.1 billion reported due to DeFi hacks. As Vietnam&#...

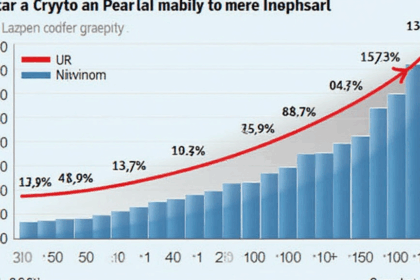

The Growing Bitcoin Market Cap in Vietnam: Trends & Insights As the cryptocurrency market continues to evolve, one metric that stands out is the market cap of Bitcoin. With the current rise in dig...

Understanding Vietnam Crypto Indices HIBT: A Deep Dive Since 2024, the Vietnam crypto indices HIBT have gained increasing attention as the demand for digital assets continues to rise. With an impressi...

Tracking Your Crypto Portfolio in Vietnam: The Ultimate Guide to HIBT In the ever-evolving world of cryptocurrencies, staying on top of your investments is crucial. With $4.1 Billion lost to DeFi hack...

Bitcoin Hedge Funds in Vietnam: Opportunities and Strategies In recent years, the rise of Bitcoin and cryptocurrency investments has captured global attention. A staggering $4.1 billion was estimated ...

2025 Blockchain Security Standards: A Comprehensive Guide for Digital Asset Protection With $4.1 billion lost to DeFi hacks in 2024, the urgency for solid Vietnam crypto insurance frameworks like HIBT...