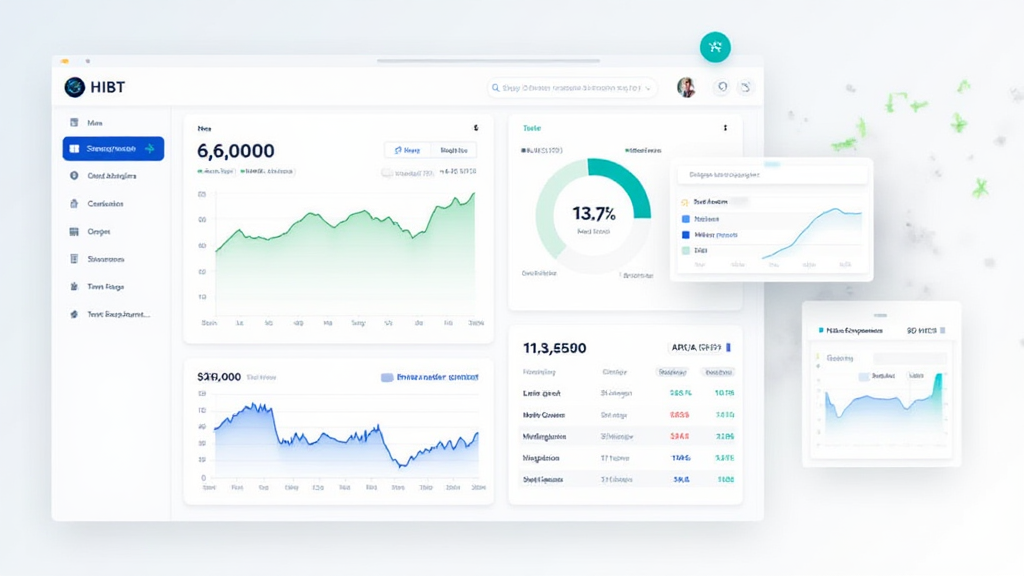

HIBT Asset Allocation Simulators: Your Path to Cryptocurrency Success

With over $4.1 billion lost to DeFi hacks in 2024, the importance of smart asset allocation in cryptocurrency has never been clearer. Investors are not just looking to double their investments; they want to protect their assets while maximizing potential gains. HIBT asset allocation simulators offer powerful tools for achieving both at a time so crucial for the cryptocurrency market. In this article, we’ll delve into how these simulators work, their significance in modern investment strategies, and why they are particularly beneficial for the rapidly expanding Vietnamese market.

Understanding Asset Allocation in Cryptocurrency

Asset allocation involves dividing your investment portfolio among different asset categories, which typically include stocks, bonds, and cash. When applied to cryptocurrency, this means balancing your investments in various digital currencies based on market trends, volatility, and your own risk tolerance. Here’s why this strategy is essential:

- Diversification: By spreading your investments across various cryptocurrencies, you can reduce risk. If one asset underperforms, others may outperform.

- Risk Management: Not every cryptocurrency has the same level of risk. Balancing higher-risk assets with more stable coins can help manage overall risk.

- Market Trends: Cryptocurrency markets are highly volatile, and using asset allocation simulators can help you track trends and make informed decisions.

How HIBT Asset Allocation Simulators Work

HIBT asset allocation simulators are designed to provide electric analytics that help investors in making data-driven decisions. Here’s a breakdown of their key functionalities:

- Real-Time Insights: The simulators update in real-time, giving you access to the latest market data and trends.

- Scenario Testing: You can simulate how different allocation strategies would have performed historically, helping you understand potential outcomes without risking actual capital.

- Customizable Parameters: Users can tailor the simulators to match their risk preferences, investment periods, and market conditions.

Main Benefits of Using Asset Allocation Simulators

The advantages of using HIBT asset allocation simulators extend across several dimensions of investment strategy:

- Informed Decision Making: They empower investors to take a scientific approach to asset allocation instead of relying solely on intuition.

- Educational Tools: Many investors, particularly in emerging markets like Vietnam, can utilize these simulators to learn about the complexities of cryptocurrency markets.

- Performance Tracking: They allow users to continually assess the effectiveness of their strategies by evaluating performance against specific benchmarks.

The Rise of Cryptocurrency Investment in Vietnam

Vietnam has seen an explosive growth in cryptocurrency adoption, with a user growth rate of over 300% in the last two years alone. This presents a ripe opportunity for innovative tools like HIBT asset allocation simulators to enter the market:

- Young Demographic: A large portion of Vietnam’s population is under 35, and they are more open to digital financial tools.

- Investing Knowledge: With increased access to the internet and educational resources, many Vietnamese are now looking to invest wisely.

For Vietnamese investors, utilizing HIBT’s simulators means tailoring their strategies based on localized benchmarks and performance metrics. It allows them to stay informed and relevant in a competitive market where understanding the tiêu chuẩn an ninh blockchain is critical.

Real-Life Applications of HIBT Asset Allocation Simulators

To illustrate the practical use of HIBT asset allocation simulators, let’s present a few case studies from users:

- User A: A seasoned investor used the simulator to optimize his portfolio. By reallocating assets based on historical data, he improved his returns by 20% over a six-month period.

- User B: New to cryptocurrency, this investor utilized the educational aspects of the simulator to begin learning asset allocation, resulting in achieving their first profitable investment.

Key Considerations When Using HIBT Tools

While HIBT asset allocation simulators provide robust analytics, here are a few considerations to keep in mind:

- Market Volatility: Remember that past performance is not always indicative of future results. Markets can change rapidly.

- Caution Against Over-Diversification: Spreading yourself too thin can lead to challenging management of assets.

- Continuous Learning: Stay abreast of blockchain renovations and investment strategies, especially within the Vietnamese context.

The Future of Asset Allocation Simulators

As we move into 2025, the integration of advanced technologies such as AI and machine learning in asset allocation simulators will only enhance platform capabilities. Following industry reports, it is estimated that tools offered by HIBT will enable:

- Predictive Analysis: Helping users make asset allocation decisions based on predictive modeling of market dynamics.

- Higher Customization: Creating personalized investment strategies that adapt automatically to asset performance changes.

Getting Started with HIBT Asset Allocation Simulators

For those ready to take control of their investment strategies and explore what HIBT asset allocation simulators have to offer, follow these simple steps:

- Visit hibt.com and create an account.

- Familiarize yourself with the simulator’s interface and functionalities.

- Input your initial investment amounts and desired objectives to start your first simulation.

To summarize, in an era where protecting your investments is paramount, tools like HIBT asset allocation simulators not only offer insight on potential growth but also equip investors with the knowledge for strategic decision making. As the cryptocurrency market evolves, having the right tools in your arsenal will ultimately determine your success.

In closing, as digital assets continue to mesh with our daily lives, navigating their complexities has never been more vital. HIBT asset allocation simulators stand out as an essential asset for both seasoned investors and newcomers alike. For a secure investment future, explore the potential these simulators offer today.

Author: Dr. Nguyen Tran, a financial analyst and blockchain technology expert with over 15 published papers in the area of cryptocurrency investment strategies and has been involved with multiple blockchain audit projects, emphasizes the importance of continuous education in achieving financial success in the crypto space. For more insights and tools, check out bitcryptodeposit.