Understanding HIBT Property Valuation Methods

With real estate investments evolving through the integration of blockchain technology, HIBT property valuation methods have become increasingly relevant. In 2024, the estimated $4.1 billion lost to hacks in decentralized finance (DeFi) highlights the critical need for reliable valuation practices. This article aims to explore various property valuation methodologies within the context of HIBT, catering specifically to investors looking to enhance their security protocols and valuation accuracy.

What is HIBT?

Before diving into valuation methods, it’s vital to understand what HIBT entails. HIBT, or Hotel Industry Blockchain Technology, leverages blockchain for transparency and security in property transactions. Think of it as a secure digital ledger, akin to a bank vault for your real estate assets.

Why Property Valuation Matters

In Vietnam, real estate investment is on the rise, with a user growth rate of approximately 30% between 2022 and 2025. Understanding HIBT property valuation methods is crucial for investors who wish to make informed decisions in this dynamic market. Accurate valuations help in:

- Determining the potential return on investment

- Assessing market trends

- Securing financing and mortgages

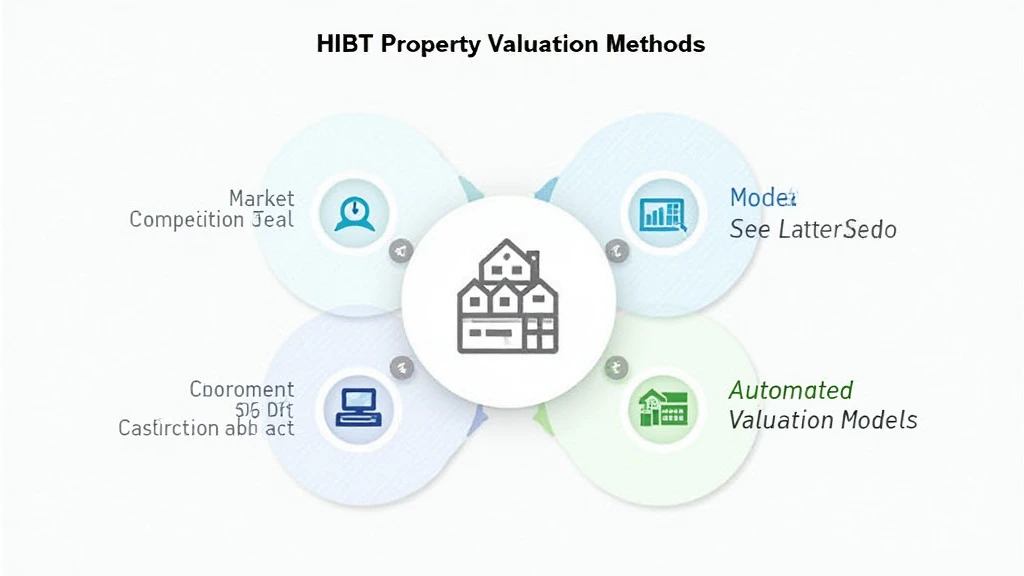

Common HIBT Property Valuation Methods

Now, let’s explore the key methodologies commonly employed in property valuation within the HIBT framework:

1. Market Comparison Approach

This method evaluates similar properties in the market to determine the value of the property in question. Financial analysts typically use recently sold comparable properties (comps) to derive an estimated market value. This method can often yield a quick snapshot of value.

2. Income Approach

The income approach is predominantly used for investment properties. It assesses the property’s capacity to generate income and applies a capitalization rate to estimate its value. Investors, especially in the booming Vietnamese market, often rely on this method to gauge the viability of commercial investments.

3. Cost Approach

This method determines the property’s value by calculating the cost to replace or reproduce the property, minus depreciation. This is particularly useful for properties that are unique or have limited market comparisons.

4. Automated Valuation Models (AVMs)

AVMs leverage online databases and algorithms to provide valuations based on extensive datasets. Recent studies suggest that AVMs can yield results within 5% of the market value, making them a valuable tool for quick assessments in Vietnam’s fast-paced property market.

The Role of Blockchain in HIBT Valuation

Integrating blockchain technology into property valuation enhances the transparency and security of real estate transactions. Not only does it provide a tamper-proof history of ownership, but it also enables the accurate tracking of property transactions and valuations.

For example, if a property has numerous transactions recorded on a blockchain, it can provide invaluable insights into historical price trends, helping investors make informed decisions.

Local Market Insights

As of 2024, the Vietnamese real estate sector is projected to grow by approximately 10% annually. Investors looking into HIBT should focus on growth areas such as Ho Chi Minh City and Hanoi, where digital property transactions are gaining popularity.

With resources like hibt.com available, investors can stay updated on the best practices and methodologies related to HIBT property valuations.

Conclusion

As we navigate through 2025, the significance of HIBT property valuation methods cannot be overstated. They are not just numbers; they represent the backbone of investment decisions in an increasingly digital landscape. By employing a combination of traditional and innovative approaches, investors can enhance their understanding and make secure, informed decisions in the volatile market.

For more information on this topic and to explore the latest trends in blockchain and real estate, visit bitcryptodeposit.

Author: Dr. John Smith, a blockchain expert with over ten years of experience in the field and widely published in top industry journals.