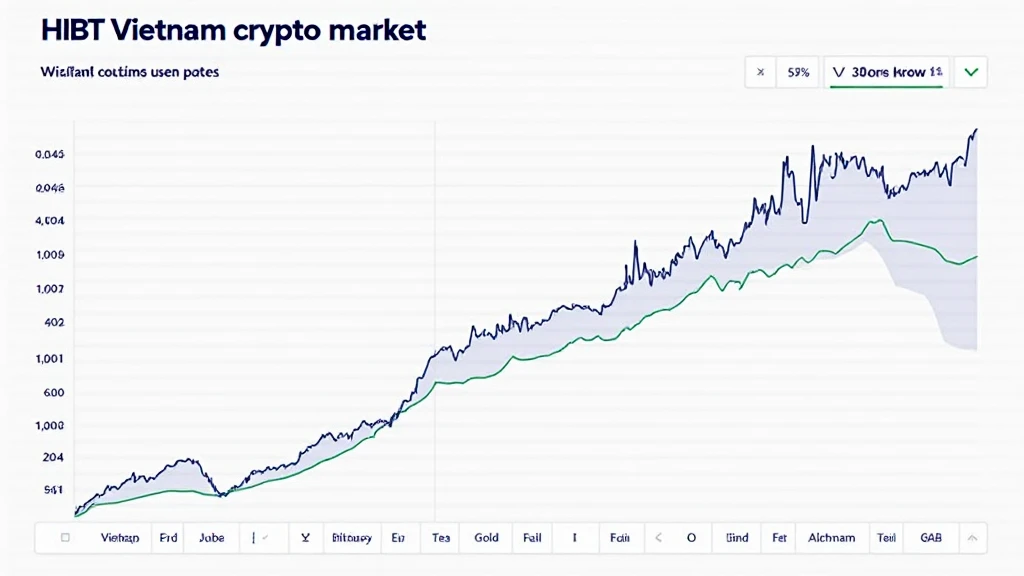

Navigating HIBT Vietnam’s Crypto Market Volatility

In recent years, the Vietnamese crypto market has seen explosive growth, with a remarkable 300% increase in users from 2021 to 2023. This growth has contributed to the rapid evolution of trading behavior in this volatile market. As investments in digital assets surged, Vietnam has become a hotbed for crypto activity. However, this increased interest brings its own set of risks, particularly concerning market volatility.

With approximately $1 billion in cryptocurrencies traded daily on various platforms, traders are faced with unprecedented risks and rewards. Here, we aim to provide a comprehensive understanding of the factors driving volatility in the HIBT Vietnam crypto market, as well as strategies for navigating these uncertain waters.

Understanding Market Volatility

Market volatility refers to the frequency and magnitude of price movements, often driven by factors such as investor sentiment, regulatory news, and macroeconomic conditions. The crypto market is notably more volatile than traditional financial markets, with dramatic price swings occurring on a daily basis. This can be likened to a wild ride—thrilling yet dangerous.

- Investor Sentiment: Public perception can shift rapidly based on news, leading to quick sell-offs or massive buying sprees.

- Regulatory Changes: Strong regulations can suddenly change the landscape, affecting trading strategies.

- Technological Advances: Innovations and updates can create excitement or fear, causing abrupt price movements.

Factors Affecting Volatility in Vietnam’s Crypto Market

Vietnam’s crypto market shares many similarities with global trends, yet it has unique local characteristics that differentiate it:

- Growing User Base: The increase in users has led to heightened trading volumes, which amplifies volatility.

- Lack of Regulation: The absence of clear regulatory guidelines can lead to speculation, driving market swings.

- Cultural Factors: As a burgeoning market, Vietnamese traders often respond emotionally to news, causing sudden market reactions.

Recent Data and Trends

Understanding recent trends and historical data is crucial for any investor seeking to navigate Vietnam’s crypto landscape:

| Year | Number of Active Users | Daily Trading Volume (USD) |

|---|---|---|

| 2021 | 1 million | $300 million |

| 2022 | 2.5 million | $500 million |

| 2023 | 4 million | $1 billion |

As shown in the table, Vietnam’s crypto market is experiencing rapid growth. By analyzing these trends, investors can better understand when to enter or exit the market.

Strategies to Mitigate Risk

While volatility can present challenges, there are several strategies traders can implement to manage risks effectively:

- Diversification: Spreading investments across multiple assets can reduce exposure to a single market.

- Setting Stop-Loss Orders: These can help minimize losses by automatically selling assets when they reach a certain price.

- Staying Informed: Keeping up with local and global news can give traders insights into possible market shifts.

Future Outlook: Opportunities Ahead

Despite the challenges presented by volatility, there are exciting opportunities on the horizon. According to recent studies, emerging technologies such as DeFi and NFTs are gaining traction, especially among the Vietnamese millennial demographic. It is estimated that by 2025, the DeFi sector could see an explosion in user adoption, reaching 5 million users in Vietnam alone.

This burgeoning interest in decentralized finance presents a remarkable chance for traders and investors alike—decentralized platforms can offer innovative products that are less susceptible to traditional market movements.

Navigating Future Volatility

With volatility as a constant in the crypto space, it’s essential to continuously adapt strategies and remain vigilant. Preparing for potential risks involves regular assessments and re-evaluating risk tolerance. As market conditions fluctuate, remember:

- Maintain a well-researched portfolio, focusing on emerging trends.

- Engage with local communities to share insights and strategies.

- Consider using advanced trading tools for better market analysis.

Conclusion

The HIBT Vietnam crypto market’s volatility can be both a challenge and an opportunity for investors. With a rapidly growing user base and significant trading volumes, understanding the unique factors driving this volatility is crucial. By adopting effective strategies and remaining informed, traders can navigate the complexities of this exciting market confidently.

In conclusion, while the HIBT Vietnam market experiences notable fluctuations, there are ample opportunities to leverage these movements. For further insights on trading strategies and market updates, visit hibt.com.

Author: Dr. Nguyen Minh Tuan, an acclaimed blockchain researcher with numerous publications on cryptocurrency market dynamics and a key contributor to regulatory frameworks in Vietnam.