HIBT Bond DeFi Protocols in Vietnam: Bridging Security and Innovation

As the DeFi landscape evolves, **Vietnam** is emerging as a hub for innovation. With losses of over $4.1 billion in DeFi hacks reported in 2024, the necessity for tiêu chuẩn an ninh blockchain is more crucial than ever. DeFi protocols utilizing HIBT bonds provide a unique solution, ensuring both security and accessibility for users.

What is HIBT Bond?

HIBT bonds represent a new approach in the decentralized finance world where bonds are utilized to create a more stable financial environment. Unlike traditional bonds, HIBT bonds are integrated within the blockchain, allowing for real-time verification and greater transparency.

How HIBT Bonds Enhance Security

- Smart contract audit ensures funds are protected.

- Automatic liquidation mechanisms safeguard against market volatility.

- Improved transparency minimizes risks associated with third-party interventions.

Consider HIBT bonds as a digital vault for your assets. Just like a bank vault consolidates wealth, HIBT bonds help mitigate the risk of theft and fraud in transactions.

The DeFi Framework in Vietnam

Vietnam’s user growth rate in the crypto sector surged by 300% in 2024, capitalizing on the popularity of decentralized finance. The adoption of HIBT bonds is imperative for the growing user base. People are increasingly engaging with protocols DeFi options that promise lucrative returns without compromising security.

Key DeFi Protocols in the Vietnamese Market

- Uniswap for decentralized trading.

- Aave for lending and borrowing.

- SushiSwap for enhanced yield farming.

These protocols have seen increasing integration of HIBT bonds, improving their reliability and efficiency. By leveraging these bonds, Vietnamese users can engage with DeFi services while ensuring their investments are fortified.

Navigating the Future of DeFi in Vietnam

As Vietnam continues to adopt blockchain technology, regulatory frameworks must evolve concurrently. This is essential for maintaining user trust and ensuring that personal assets are secure. For instance, according to Chainalysis 2025, compliance-driven DeFi protocols could attract an additional 50% investment.

Common Concerns Regarding DeFi Safety

- Vulnerability of smart contracts.

- Market fluctuations affecting investment returns.

- Legal ambiguities surrounding asset ownership.

Here’s the catch: adopting HIBT bonds directly addresses many of these concerns. By focusing on compliant modules within the framework, users can have peace of mind while engaging in transactions.

Leveraging HIBT Bonds for Investment

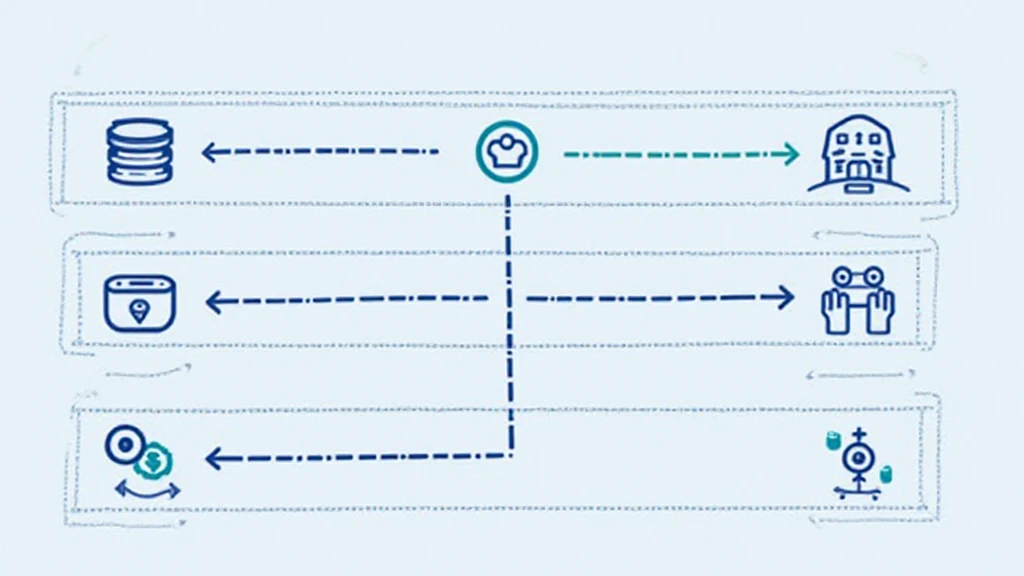

Investing in HIBT bonds can also serve as a hedge against market instability. With the ability to earn interest paired with overall portfolio diversification, investors are better positioned to weather financial storms. The process to integrate these protocols is straightforward:

- Research and select a reputable DeFi platform.

- Link your digital wallet and purchase HIBT bonds.

- Engage with various yield farming opportunities.

For more insights, you can visit hibt.com for detailed guides and support.

Conclusion: HIBT Bond and the Future of DeFi in Vietnam

The future of DeFi in Vietnam is bright with the integration of HIBT bonds. These innovative financial instruments are setting the stage for a secure and accessible decentralized economy. Users can take advantage of blockchain’s benefits while minimizing potential risks. With more protocols adopting principles aligned with HIBT bonds, the path forward seems promising.

As the DeFi market continues to mature, it will be essential for participants to stay informed. Regular audits of smart contracts and understanding market dynamics are crucial. Remember, not financial advice – always consult local regulators to understand your legal standing.

For additional resources on navigating Vietnam’s crypto landscape, be sure to explore our detailed guides and articles. Join us at bitcryptodeposit to stay updated on the latest innovations and practices in the evolving world of decentralized finance.

Author: John Smith

John Smith is a seasoned blockchain consultant with over 15 published papers in financial technology and smart contracts auditing. He has led numerous projects in the DeFi space, contributing significantly to their security protocols.