Introduction

With recent data indicating that $4.1B was lost to DeFi hacks in 2024, the importance of robust portfolio diversification strategies in cryptocurrency has never been clearer. Within the volatile crypto market, investors are constantly seeking methods to safeguard their assets while maximizing returns. This guide aims to provide invaluable insights into the hibt portfolio diversification strategy that has been gaining traction in the industry.

Understanding Portfolio Diversification

What is Portfolio Diversification?

Portfolio diversification is the practice of spreading investments across various assets to reduce risk. By not putting all your eggs in one basket, you can mitigate potential losses from any single investment. In the realm of cryptocurrencies, this means investing in a variety of coins and tokens rather than concentrating on just one or two.

Why is it important?

- Reduces Risk: Diversification minimizes the impact of a poor-performing asset on the overall portfolio.

- Enhances Returns: By investing in different assets, you can capitalize on the growth of various segments in the market.

- Provides Stability: A diversified portfolio tends to perform better during market volatility.

The Hibt Portfolio Diversification Strategy

The hibt portfolio diversification strategy is tailored specifically for crypto investors looking to optimize their holdings. Here are the fundamental aspects:

1. Asset Classes in Diversification

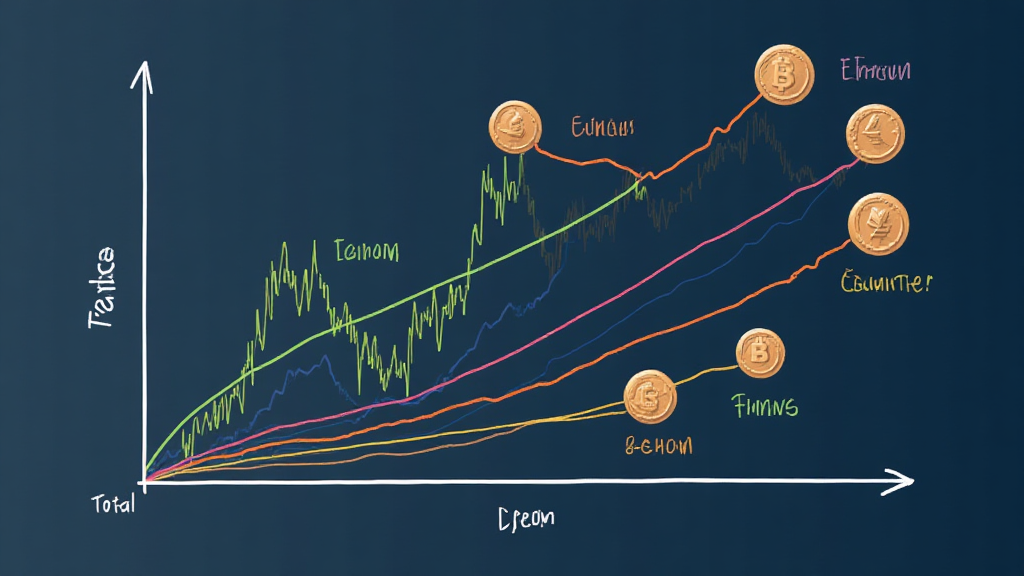

To implement a successful strategy, it’s crucial to understand the different asset classes available in the crypto market. These can be categorized generally into:

- Cryptocurrency: The primary assets like Bitcoin and Ethereum.

- Tokens: Utility tokens and security tokens that serve specific purposes within a network.

- Stablecoins: These are pegged to traditional currencies and help maintain a stable value.

2. Geographic Considerations

Investors should also consider geographic diversification. For instance, Vietnam has shown remarkable growth in cryptocurrency adoption, with recent reports indicating a 300% increase in local crypto users in the last year. This presents a unique opportunity for investors to tap into emerging markets.

3. Risk Assessment and Management

Identifying your risk tolerance is essential. A standard approach is to categorize investments into three levels of risk:

- High Risk: Emerging cryptocurrencies with high volatility.

- Medium Risk: Established cryptocurrencies with a track record.

- Low Risk: Stablecoins and fiat-backed assets.

Case Studies: Successful Diversification

Let’s look at some examples of successful hibt portfolio diversification strategies utilized by seasoned investors.

1. Diversification in Action

A renowned investor applied the hibt strategy by allocating:

This strategy not only minimized risks but also took advantage of the growing DeFi sector.

2. The Vietnamese Market Impact

In Vietnam, one portfolio manager focused on diversifying into emerging altcoins that gained traction locally, which boosted their portfolio by 50% in just six months.

Practical Tools for Diversification

To assist in maintaining an effective diversification strategy, consider the following tools:

- Portfolio Trackers: Tools like Blockfolio and CoinStats.

- Risk Management Tools: A tools like CryptoCompare for assessing market data.

- Market Analysis Software: Tools that provide real-time analytics and news.

Final Thoughts

Mastering the art of portfolio diversification is crucial for anyone involved in the cryptocurrency space. With volatile markets, implementing a robust strategy such as the hibt portfolio diversification strategy becomes a necessity for risk management. As the Vietnamese market continues to grow, now is the perfect time to apply these principles.

Stay updated on industry trends and consider leveraging effective tools and strategies. Consult with experts and utilize reliable resources to further enhance your portfolio. For more detailed insights, visit hibt.com.

By following these guidelines, you can lead yourself toward a successful investment journey in cryptocurrencies.

**Author: Dr. Emily Thompson,** a leading blockchain consultant and an expert in digital asset management, has published over 20 papers in this field and has led various well-known projects’ audits in cryptocurrency security.