Liquidity Mining Crypto Guide: Unleashing Potential in DeFi

With over $10 billion locked in liquidity pools as of mid-2024, the revolution in decentralized finance (DeFi) is undeniable. The growing number of participants in liquidity mining indicates the rising interest among crypto enthusiasts in these innovative financial mechanisms. Not only does liquidity mining offer attractive yields, but it also empowers users to play a vital role in the ecosystem. This article aims to provide an in-depth look at liquidity mining, its benefits, risks, and how you can effectively participate in this rapidly evolving space.

Understanding Liquidity Mining

Liquidity mining allows users to earn rewards by providing liquidity to DeFi protocols, usually in the form of tokens. Think of it as a peer-to-peer lending system where your assets work for you. When you deposit cryptocurrency into a liquidity pool, you’re essentially lending your funds to other users who wish to trade. This system is akin to a well-oiled machine, where each participant contributes to its efficiency.

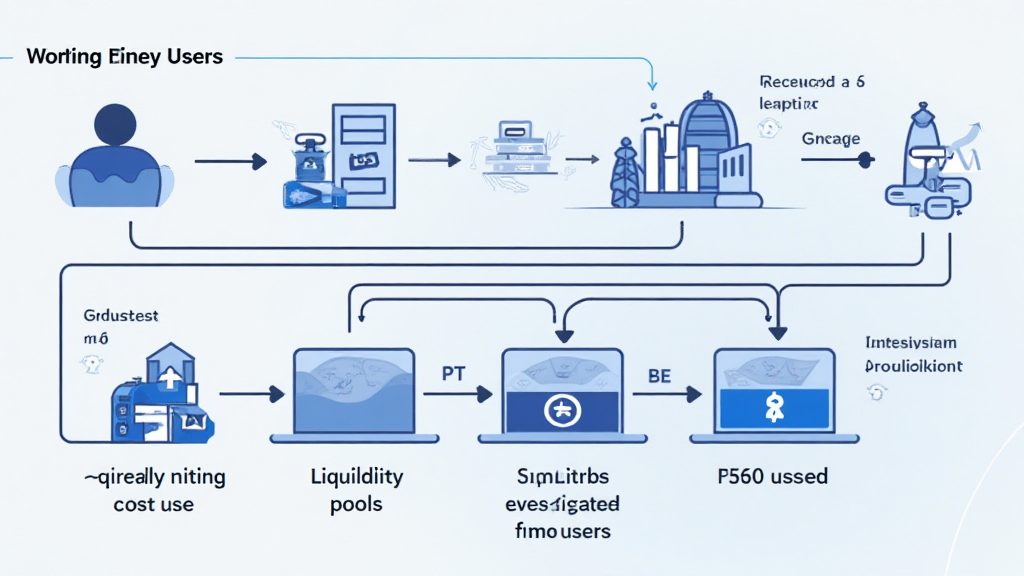

How Does Liquidity Mining Work?

- Deposit Assets: Users deposit their cryptocurrencies into a liquidity pool.

- Earn Tokens: In return, users receive liquidity tokens representing their stake in the pool.

- Receive Rewards: Users earn a portion of transaction fees generated from trades within the pool, as well as governance tokens.

It’s important to note that the rewards often come in the form of governance tokens, which grant users voting rights on the future developments of the protocol. This creates a sense of community ownership.

Benefits of Liquidity Mining

One of the main attractions of liquidity mining is the potential for high returns compared to traditional investment methods. Here are several benefits to consider:

- High Yields: Depending on the protocol, returns can range from 5% to over 100% APY.

- Participation in Governance: Holding governance tokens allows you to influence the direction of the protocol.

- Diversification: Liquidity mining can spread risk across multiple assets and platforms.

Risks Involved with Liquidity Mining

While the potential rewards are enticing, liquidity mining comes with inherent risks. Here’s what you need to be aware of:

- Impermanent Loss: Fluctuations in token prices can lead to losses compared to simply holding the tokens.

- Smart Contract Vulnerabilities: Bugs in the code can lead to hacks and loss of funds.

- Market Volatility: The crypto market can experience rapid fluctuations, affecting your strategy and returns.

Key Strategies for Successful Liquidity Mining

If you’re considering diving into liquidity mining, here are some strategies to help maximize your returns:

- Market Research: Stay updated on market trends and project developments. Using resources like hibt.com can provide insights.

- Choose Trusted Platforms: Opt for protocols with robust security measures and a verified track record.

- Diversify Your Investment: Spread your assets across different pools and projects to mitigate risks.

Liquidity Mining in Vietnam’s Growing Market

The interest in DeFi, particularly liquidity mining, has seen a significant increase in Vietnam, with a reported 250% growth in crypto adoption among local users in the past year. This rising trend reflects broader regional patterns as Southeast Asia becomes a hotbed for crypto innovation. Local projects and platforms are emerging, making it easier for users to participate in liquidity mining.

As a rapidly developing market, the Vietnamese government’s regulatory stance on cryptocurrency is critical. It’s advisable for users to remain informed about tiêu chuẩn an ninh blockchain and compliance requirements in the country.

Security Practices for Liquidity Mining

Ensuring the safety of your investments should be a primary concern. Here are some essential security practices:

- Use Hardware Wallets: A hardware wallet can protect your tokens from online hacks.

- Always Conduct Audits: Before investing in a liquidity pool, check the project’s audit history, especially focusing on how to audit smart contracts.

- Stay Aware of Phishing Scams: Avoid clicking on unknown links and always verify website URLs.

Conclusion

Liquidity mining offers a unique opportunity for crypto enthusiasts and investors to participate actively in the decentralized finance ecosystem. While it comes with significant risk, understanding the ins and outs of liquidity mining through well-researched strategies can lead to significant rewards. Be mindful of the security practices and stay updated with market trends for a successful experience in this vibrant sector.

For comprehensive insights and guidance on navigating the burgeoning space of decentralized finance, visit bitcryptodeposit. Remember to consult local regulators, as the crypto landscape is ever-evolving.

Author: Alex Tran, a financial analyst and blockchain enthusiast, has published over 30 papers on decentralized finance and has led several audits for prominent projects. Alex specializes in market strategies and security analyses.