Bitcoin Mining Difficulty Analysis: Understanding the Future of Mining

With an average of 60% of the global Bitcoin mining capacity located in just four countries, understanding the mining difficulty is more crucial than ever. The landscape of Bitcoin mining is continuously changing, driven by factors like energy consumption, technological advancements, and regulatory environments. For those involved in cryptocurrency, grasping the concept of Bitcoin mining difficulty is not just important; it’s essential to making informed decisions.

What is Bitcoin Mining Difficulty?

Bitcoin mining difficulty refers to how hard it is to find a new block in the Bitcoin blockchain. It adjusts approximately every two weeks to maintain an average block time of 10 minutes, accommodating for changes in network hashrate. In simpler terms, the more miners that join the network, the harder it becomes to mine a Bitcoin block.

How is Mining Difficulty Calculated?

- The network hashrate is assessed, which is the total computational power used by miners.

- A target interval is set (currently 2016 blocks), and once this interval is complete, the Bitcoin network recalibrates its difficulty based on how quickly the last 2016 blocks were mined.

- If the blocks were mined too quickly, the difficulty increases to slow down future block creation.

This recalibration allows Bitcoin to adjust to fluctuations in mining capabilities, ensuring stability in its issuance rate.

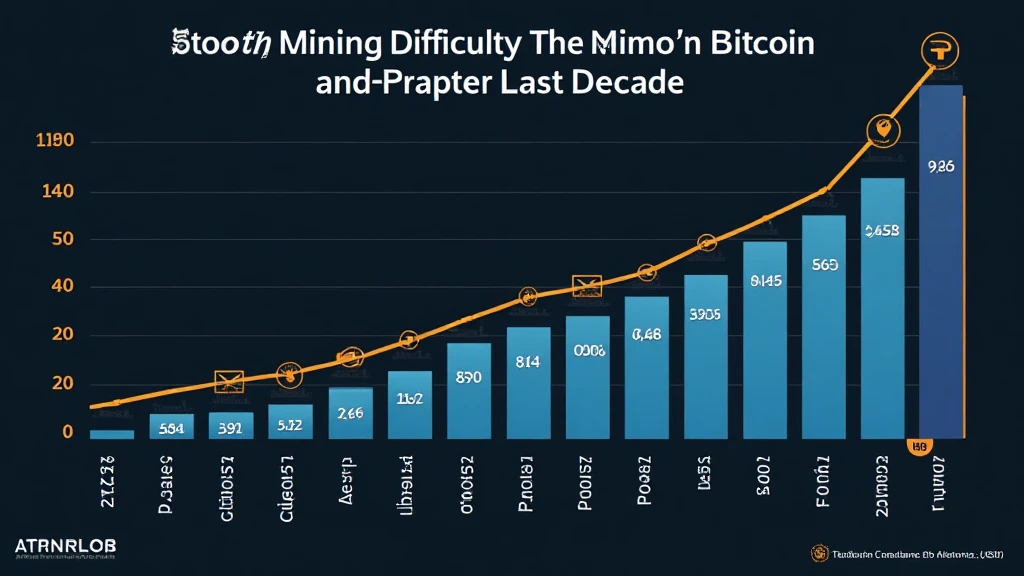

The Evolution of Mining Difficulty

Since Bitcoin’s inception, mining difficulty has undergone several transformations:

- 2009-2015: The Early Years – Initial difficulty was very low, allowing individual miners to compete effectively using standard PCs.

- 2016-2020: Rise of ASICs – Application-Specific Integrated Circuits (ASICs) revolutionized mining, leading to exponential increases in mining difficulty.

- 2021-Present: Institutional Investment – With institutional investments and increased regulatory scrutiny, mining difficulty has fluctuated even more as large operations ramp up their efficiencies.

Understanding how these historical changes shape current trends offers valuable insights for new entrants considering entering the Bitcoin mining space.

Why is Understanding Mining Difficulty Important?

There are several reasons why Bitcoin mining difficulty is critical:

- Profitability: Understanding the difficulty helps miners gauge potential profits based on their operational costs.

- Market Trends: An analysis of mining difficulty trends can indicate larger market movements.

- Strategic Planning: By anticipating changes in mining difficulty, miners can make informed decisions on when to scale operations or invest in more efficient equipment.

With a projected increase in Vietnam’s cryptocurrency adoption rate (an estimated 35% growth expected in 2025), localized understanding becomes even more pertinent for miners in that market, especially when considering compliance with local regulations.

Factors Influencing Mining Difficulty

Several elements impact Bitcoin mining difficulty:

- Network Hashrate: The collective hash power of all miners directly influences difficulty.

- Mining Equipment: The efficiency of miners’ hardware plays a crucial role, with more powerful and energy-efficient ASICs allowing for faster block solving.

- Energy Costs: Given that mining profitability is heavily reliant on energy expenses, fluctuations in energy prices can influence how many miners decide to keep participating in the network.

This aspect becomes incredibly relevant when considering Vietnam’s emerging market, with energy policies evolving to facilitate or hinder mining operations.

Historical Data on Mining Difficulty Adjustments

| Timeframe | Mining Difficulty |

|---|---|

| July 2021 | 15.79 T |

| July 2022 | 20.62 T |

| July 2023 | 27.94 T |

This data illustrates a clear upward trajectory, emphasizing the importance of strategic decision-making for current and future miners.

The Future of Bitcoin Mining Difficulty in 2025

As we look ahead to 2025, several factors will shape the future of Bitcoin mining difficulty:

- Continued ASIC Innovation: With advancements in mining technologies, miners will need to stay updated to remain competitive.

- Regulatory Changes: Governments around the world are increasingly focusing on crypto regulations, affecting how and where miners can operate legally.

- Environmental Concerns: The crypto community faces scrutiny over energy consumption; innovation in sustainable mining practices may influence future difficulty levels.

In Vietnam, regulatory frameworks are still being established, indicating that local miners should remain informed about potential changes that could affect difficulty adjustments.

How to Monitor Mining Difficulty Effectively

Here are key strategies for effectively monitoring Bitcoin mining difficulty:

- Use mining pool dashboards that provide real-time data.

- Follow Bitcoin difficulty adjustment news on forums and Google Alerts.

- Engage with communities on platforms like Hibt.com for updated insights.

By staying informed, miners will be better equipped to adapt their strategies effectively, ensuring operations remain profitable.

Conclusion

In conclusion, Bitcoin mining difficulty analysis is a critical element for anyone involved in cryptocurrency mining today. As we head toward 2025, understanding the factors that affect mining difficulty, the expected mining landscape, and localized regulations in countries like Vietnam is paramount. With a significant user growth predicted, it is essential for miners to adapt swiftly to ensure sustainability and profitability.

In this rapidly evolving space, utilizing platforms like bitcryptodeposit can provide the necessary tools for success as you navigate the complexities of Bitcoin mining.

For deeper insights, this article was compiled by Dr. Alex Chen, a well-respected blockchain analyst with over 15 published papers on cryptocurrency economics and a contributor to notable industry audits.