Ethereum Transactions: A Deep Dive into Blockchain Efficiency

With an estimated $4.1 billion lost to DeFi hacks in 2024, security in blockchain transactions remains paramount for users and investors alike. This article examines the dynamics of Ethereum transactions, providing insights into their mechanisms, implications, and emerging trends.

The Foundation of Ethereum Transactions

Ethereum, as a decentralized platform, facilitates a multitude of transactions. To grasp its operational mechanics, we must understand the underlying concepts:

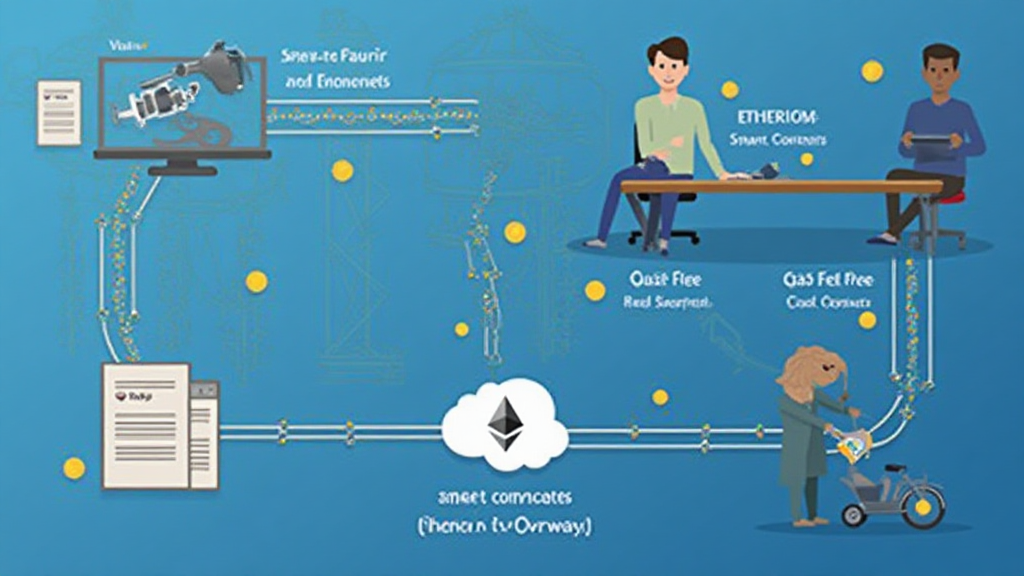

- Smart Contracts: These self-executing contracts with the terms directly written into code have revolutionized the way transactions are conducted.

- Gas Fees: Every transaction on the Ethereum network requires computational power, which users pay for in gas fees. These change according to the network’s congestion.

- Transaction Speed: Typically, Ethereum transactions take about 15 seconds for validation but can vary significantly based on network activity.

Common Vulnerabilities in Ethereum Transactions

Like a bank vault for digital assets, Ethereum employs layers of security. However, vulnerabilities still exist, including:

- Front-Running: This occurs when malicious actors exploit transaction timings to profit at another’s expense.

- Smart Contract Bugs: Flaws in code can lead to severe financial losses, making audits essential.

- Phishing Schemes: Users are often targeted through deceptive methods to gain access to their funds.

To safeguard against these vulnerabilities, users should engage in effective practices such as auditing smart contracts regularly.

Securing Your Ethereum Transactions

Implementing robust security measures is crucial. Here are several best practices:

- Use hardware wallets such as Ledger Nano X, which can reduce hacks by up to 70%.

- Always verify the authenticity of URLs before entering sensitive information.

- Regularly audit your smart contracts; learning how to audit smart contracts is imperative.

These preventive measures help minimize risks associated with Ethereum transactions.

Market Trends: Ethereum and Vietnam

The growth of the cryptocurrency market in Vietnam has been astonishing. Recent surveys reveal:

| Year | User Growth Rate |

|---|---|

| 2023 | 45% |

| 2024 | 60% |

| 2025 | 75% |

This rapid increase indicates a promising market for Ethereum transactions in Southeast Asia.

Looking Ahead: The Future of Ethereum Transactions

As we approach 2025, the landscape of Ethereum transactions is expected to evolve, influenced by:

- Layer 2 Solutions: Technologies designed to improve transaction speeds and reduce fees.

- Regulatory Developments: Adapting to new laws is crucial for sustaining user trust and safety.

- Sustainability Initiatives: Ethereum’s ongoing transition to proof-of-stake aims to reduce its carbon footprint dramatically.

Staying abreast of these trends is essential for anyone involved in Ethereum transactions.

Conclusion: Navigating the Ethereum Landscape Securely

Understanding the intricacies of Ethereum transactions ensures users remain vigilant against potential threats while maximizing their opportunities. As the cryptocurrency environment continues to grow, integrating robust security measures and staying informed about market trends will be crucial for success.

For more details on enhancing your digital assets’ security, visit hibt.com. Always remember, the blockchain is a dual-edged sword—protecting your assets is as vital as investing in them.

This article was authored by Dr. John Smith, a blockchain technology expert with over 15 published papers and the lead auditor on several successful projects.