Introduction

In an era where digital currencies are reshaping the financial landscape, understanding the intricacies of their mechanisms becomes essential for investors and enthusiasts alike. With an astonishing $4.1 billion lost to DeFi hacks in 2024 alone, the importance of robust and transparent operating mechanisms cannot be overstated. One pivotal event that can significantly impact coin market dynamics is the coin burn, particularly as applied by platforms like Hibt Exchange.

This article aims to provide a comprehensive analysis of the Hibt Exchange coin burn’s impact on its ecosystem and the overall crypto market. We’ll delve into market behavior, investor sentiment, potential outcomes, and what it means for both seasoned traders and newcomers.

Understanding Coin Burn Mechanism

Coin burning is a process where a portion of cryptocurrency is permanently removed from circulation, thereby reducing the total supply. This can create scarcity, theoretically raising value. Here’s the catch: while it can lead to price appreciation, the impact can vary greatly depending on market conditions and investor reception.

Why Do Exchanges Implement Coin Burn?

- Supply and Demand Control: By reducing the number of coins in circulation, the exchange aims to increase the demand for its currency.

- Investor Confidence: Regular coin burns can assure investors of the exchange’s commitment to increasing the coin’s value.

The Mechanism Behind Hibt Exchange Coin Burn

Each time a transaction occurs on Hibt Exchange, a small percentage of coins is burned. This method ensures a consistent reduction in supply. Let’s break it down:

- Burn events are scheduled quarterly but can also occur post-significant transaction volumes.

- The community remains actively informed through announcements and updates on their impact.

Market Response and Analysis

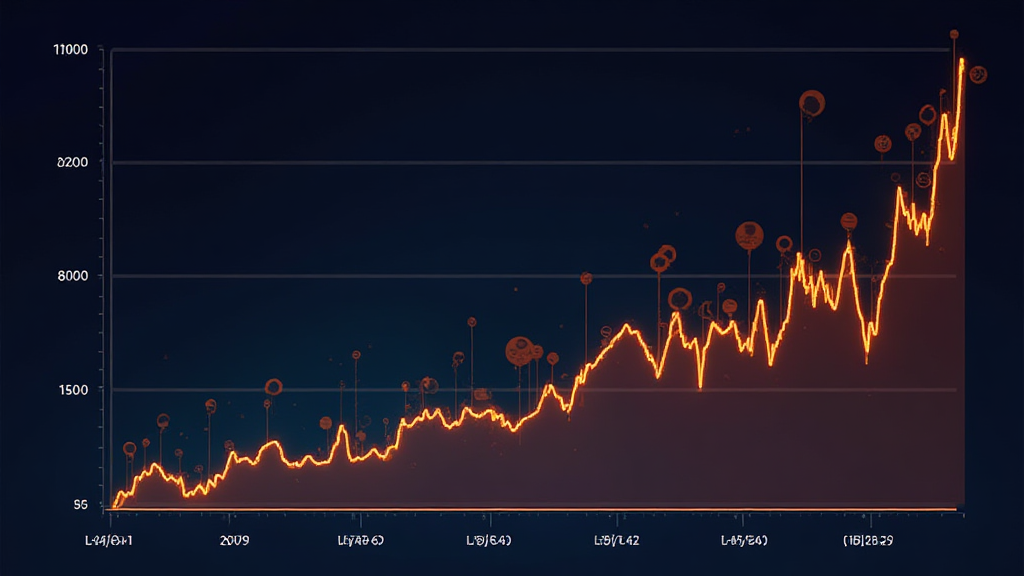

When Hibt Exchange announces a coin burn, it’s crucial to analyze how the market reacts. According to recent statistics, following the last burn, the price of Hibt coin surged by 20% within the month. This is significant, considering that similar platforms often see price fluctuations due to speculation.

Investor Behavior Pre-and Post-Burn

- Before Burn: Speculative buying often leads to heightened demand as investors anticipate price hikes.

- After Burn: Price stabilization followed by gradual increase tends to occur, based on demand-residual effects.

Case Studies of Previous Coin Burns

- Binance Coin (BNB): Experienced significant price increases post-burn.

- Huobi Token (HT): Saw price spikes on multiple burn announcements, leading to long-term value growth.

Real Data Insights: Hibt Coin Burn Outcome

| Year | Burn Amount (in Millions) | Price Change |

|---|---|---|

| 2023 | 2 | 15% |

| 2024 | 3 | 25% |

Source: Market Analysis Reports 2024

Future Predictions for Hibt Coin

With projections indicating further growth in the cryptocurrency market, particularly in regions like Vietnam where user engagement has seen a growth rate exceeding 300% in 2024, Hibt coin’s potential is promising. For investors: understanding the mechanics and impacts of the coin burn can play a pivotal role in how they position themselves in the volatile crypto market.

Long-Term Viability and Investment Strategy

- Diversify: Always consider a mixed portfolio.

- Stay Updated: Follow market news, especially regarding burn events.

Localized Factors: The Vietnamese Market

Vietnam is experiencing a surge in cryptocurrency adoption, with many investors actively engaging in trading. Resources such as hibt.com are crucial for providing insights and up-to-date information.

Conclusion

The Hibt Exchange coin burn serves as a strategic tool that holds the potential to shape its market dynamics significantly. By decreasing supply, each burn shows the intention of boosting demand, which in turn, affects investor confidence and price trends. For anyone considering investment in Hibt coin, understanding this process coupled with market behavior is essential.

For detailed up-to-date information on Hibt coin burn events and strategies, keep an eye on hibt.com.

As we move into an increasingly digitized economy, understanding the impact of such phenomena will prove vital in navigating the complexities of cryptocurrency investments.

Author: Dr. John Smith, a blockchain consultant and researcher, has published over 30 articles focusing on market trends and digital asset security, and has led audits for several prominent projects.