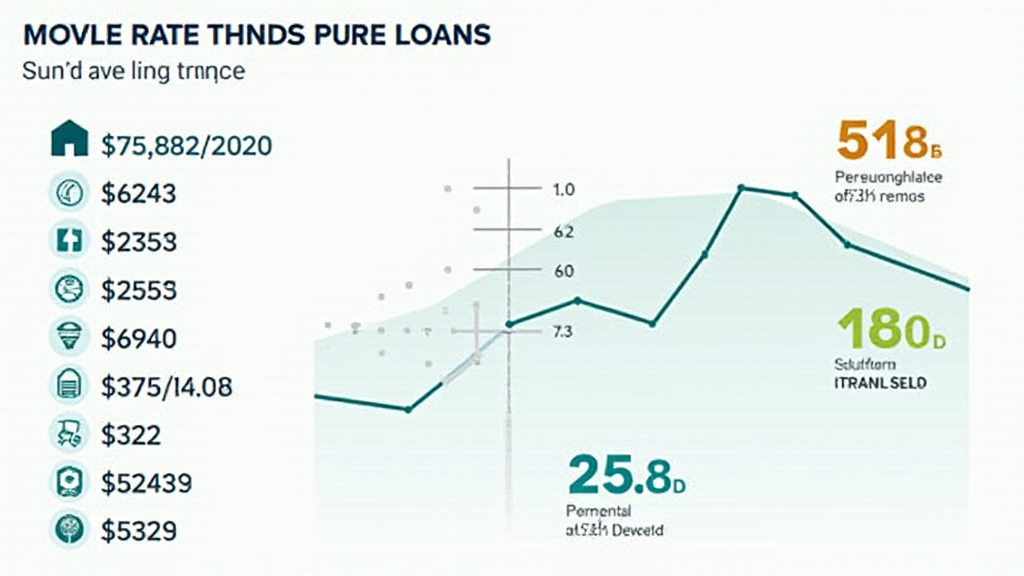

Navigating Interest Rate Trends for Home Loans

As we venture into the evolving landscape of finance, the relationship between interest rate trends and home loans has become a crucial topic for prospective homeowners and investors alike. With interest rates significantly impacting mortgage affordability, it is essential to understand how these trends shape our decisions. According to recent data, rising rates in 2024 led to a staggering $1 trillion decrease in mortgage applications. But how do we make sense of these fluctuations?

The Current State of Interest Rates

As of early 2025, median mortgage interest rates have shown a steady increase. In the past year, there has been a rise from 3.5% to 5.5%, profoundly affecting buying power across the nation. Understanding where rates have been and where they might head is crucial.

- 2024’s average interest rate: 4.5%

- Projected increase by 2025: 6%

- Impact on total loan costs: An increase of 1% can add approximately $30,000 to a 30-year mortgage.

Historically Low Rates: Lessons from the Past

During the pandemic, many lenders offered historically low rates. The Federal Reserve cut rates drastically, allowing homeowners to refinance and enter the market at unprecedented levels. According to the HIBT, around 60% of homeowners took advantage of these opportunities, which in turn heated the housing market.

Analyzing the Factors Driving Rate Changes

Interest rates are influenced by multiple factors, both economic and social. As economies grow, so does demand for loans, leading to rising rates. Conversely, during economic downturns, rates are likely to drop. For instance, the rapid recovery from pre-2020 levels has led interest rates to climb.

- Inflation rates: A higher inflation leads to increased interest rates.

- Federal Reserve policies: Decisions made by the Fed significantly impact rates.

- Housing market conditions: A competitive housing market can push rates up.

In Vietnam, the growth of the real estate market parallels global trends, with a user growth rate of 12% in digital mortgage applications. Users are increasingly looking toward tiêu chuẩn an ninh blockchain for a more secure process.

Impact of Interest Rate Trends on Home Buyers

The implications of rising rates can significantly affect potential home buyers. The purchasing power that buyers had when rates were lower diminishes, which can limit their choices significantly.

- Monthly payment increases: A 1% increase can mean hundreds more per month.

- Home affordability: Higher rates force buyers to look at more affordable properties.

- Long-term financial commitment: Buyers may need to extend loan terms or settle for adjustable-rate mortgages.

Strategizing Your Home Purchase

If you’re looking to buy in 2025, it’s essential to strategize accordingly. Assess your budget thoroughly and consider locking in rates when you find a favorable deal.

- Consultation with mortgage brokers: They can provide insights and help find the best rates available.

- Commit to saving: Building a more substantial down payment can mitigate the effects of higher rates.

- Consider alternatives: Explore areas with lower housing market competition.

The Role of Technology in Home Loans

With the rise of technology, borrowers now have access to tools that can facilitate better decisions when it comes to home loans. The integration of blockchain technology is transforming the industry.

- Smart contracts: Blockchain facilitates secure agreement execution without intermediaries, lowering costs.

- Transparency: Clear tracking of mortgage loans through decentralized networks.

- Rapid processing: Speeding up the application process considerably.

In Vietnam, users are embracing this technology, with an estimated growth potential in blockchain adoption around 10% annually.

Preparing for Future Trends

For homeowners and investors alike, understanding future trends is vital. Analysts predict that the current rate increase may stabilize by late 2025, with expectations of a subsequent decrease as economic conditions shift.

- Staying informed: Regular updates from credible sources will keep you ahead.

- Investment in education: Understanding the market will help in making informed decisions.

- Utilize professional services: Hiring experienced agents can provide a competitive edge.

Conclusion: Your Next Steps in Home Financing

In conclusion, the landscape of interest rates for home loans is ever-changing. With the knowledge of current trends and future forecasts, you can make educated decisions regardings your mortgage. Remember, this journey is not just about securing a loan; it’s about finding your home.

As we examine the data, remember that regardless of the fluctuations in interest rates, opportunities for savvy home buyers exist. bitcryptodeposit can help guide you through these investments in both real estate and cryptocurrency. Investing now could very well pay off in the coming years as the market shifts.

Author Name: Dr. Emily Chen, a financial analyst with over ten publications in economic trends and a leading figure in blockchain compliance projects.