Exploring Crypto Arbitrage Opportunities in Vietnam Exchanges

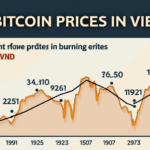

With the rise of cryptocurrency trading, various opportunities have emerged, particularly in emerging markets like Vietnam. The recent data indicating a growth of 300% in cryptocurrency investments among Vietnamese users within the last year indicates a thriving landscape for traders. But, how do these traders maximize their profits? This is where crypto arbitrage comes into play.

What is Crypto Arbitrage?

Crypto arbitrage involves buying a cryptocurrency on one exchange at a lower price and selling it on another exchange where the price is higher. Much like supermarket shoppers looking for the best deals, savvy traders constantly scour the market for price discrepancies.

Understanding Exchange Dynamics in Vietnam

Vietnam’s cryptocurrency landscape consists of several exchanges, each with its own price dynamics. According to reports, exchanges like Binance and Huobi serve as the major platforms, showcasing differing prices for popular cryptocurrencies like Bitcoin and Ethereum. Recognizing these price differences can yield significant profit opportunities.

- Binance: Known for its large volume and liquidity, Binance typically has lower fees, attracting many traders.

- Huobi: Offers a wide variety of altcoins, which may have unique price movements not reflected on larger exchanges.

Identifying Arbitrage Opportunities

Traders must be quick to capitalize on crypto arbitrage opportunities, as price discrepancies often last for very short periods. Here are three practical steps to identify these opportunities:

- Monitor Price Differences: Utilize tools or software that track prices across different exchanges to spot discrepancies in real-time.

- Consider Transfer Times: Factor in the time it takes to transfer the cryptocurrency between exchanges, as this can eat into profits.

- Stay Updated with Market Trends: Keep an eye on news and developments within the Vietnamese crypto space that might affect currency prices.

Benefits of Crypto Arbitrage in Vietnam

Engaging in arbitrage trading in Vietnam presents several advantages:

- Low Entry Barriers: With a growing number of exchanges, entry barriers for trading are relatively low.

- Diverse Market: The presence of various local and international exchanges means more potential opportunities to seize upon.

- Increasing Regulation: As the government continues to regulate the crypto space, legitimacy increases, attracting more participants.

Challenges in Crypto Arbitrage

While the opportunities are plentiful, there are challenges:

- Transaction Fees: High fees could reduce overall profit margins, thus traders need to choose exchanges wisely.

- Market Volatility: The rapid change in market prices can lead to losses if trades are not executed swiftly.

- Legal Regulations: Understanding and complying with local regulations is critical. For instance, ensure compliance with the ‘tiêu chuẩn an ninh blockchain’ before engaging in trading.

Examples of Successful Arbitrage in Vietnam

Let’s delve into a few real-world examples to understand how arbitrage trading works in Vietnam:

“In December 2022, one Vietnamese trader successfully bought Bitcoin on Binance for $45,000 and sold it on Huobi for $46,500. After accounting for transaction fees and costs, they made a profit of nearly $1,200 in just under an hour.”

The Role of Technology in Crypto Arbitrage

Today, using algorithms and trading bots has become a standard approach in arbitrage trading. Technologies like API integration allow traders to set up automated strategies that can execute trades within milliseconds.

- Signal Alerts: Many traders use alert systems that notify them when price discrepancies exceed a certain threshold, ensuring timely trades.

- Data Analysis Tools: Employ data analytics platforms that offer insights into price trends across various exchanges.

Conclusion: The Future of Crypto Arbitrage in Vietnam

As the cryptocurrency market continues to evolve, especially in Vietnam, investors and traders have a prime opportunity to benefit from crypto arbitrage. While challenges exist, educating yourself and preparing adequately can help in mitigating risks.

Overall, the question isn’t just whether to participate in crypto arbitrage, but how to employ the right strategies effectively. Your next step? Start monitoring the exchanges today and watch for those price discrepancies!

For more insights on crypto trading, visit hibt.com and broaden your understanding of potential profits in the crypto world.

Author: Dr. Minh Nguyen, a blockchain technology consultant and expert, has authored over 20 publications in the field and led audits for several high-profile projects in Southeast Asia.