Vietnam Crypto Tax Rebate Eligibility: Your Complete Guide

Introduction

As Vietnam continues to embrace the world of digital currencies, more investors are entering the crypto market. However, with the rise in crypto activities, questions around taxation have become prominent. Did you know that in 2024, approximately $4.1 billion was lost to DeFi hacks? This alarming statistic highlights the importance of understanding the Vietnamese crypto landscape, especially when it comes to Vietnam crypto tax rebate eligibility.

This article aims to clarify the criteria for tax rebates for crypto investors in Vietnam and the implications on their overall investment strategies.

Understanding Crypto Taxation in Vietnam

Vietnam’s approach to cryptocurrency taxation is relatively new and evolving. The government has established a framework that categorizes digital assets as commodities, affecting how taxes are levied on transactions.

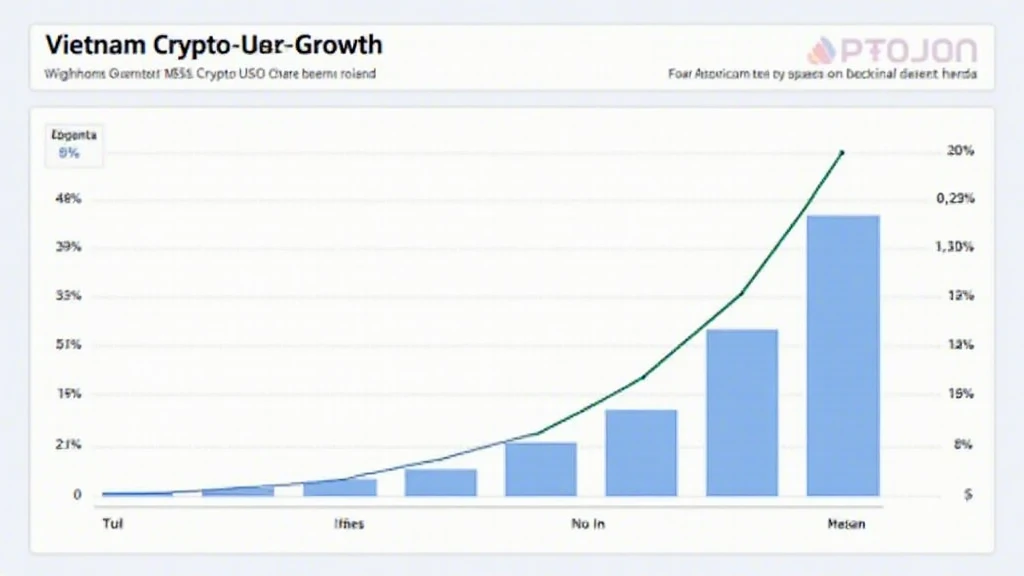

- According to recent studies, Vietnam’s crypto user growth rate has surged by over 150% in the past year, making it one of the fastest-growing markets in Southeast Asia.

- Tax authorities are evaluating regulations to ensure compliance and capture revenue from digital transactions.

Types of Taxes Applicable to Cryptocurrencies

Investors should be aware of several key tax types applicable to their crypto activities:

- Income Tax: Profits from crypto trading are subject to personal income tax.

- Value-Added Tax (VAT): Transactions involving cryptocurrencies may incur VAT, depending on the nature of the sale.

- Capital Gains Tax: This applies to profits earned from the sale of cryptocurrencies.

Criteria for Tax Rebate Eligibility

Understanding the eligibility criteria for tax rebates can significantly benefit investors. Here’s what you need to know:

- Holding Period: To be eligible for tax rebates, the investor must have held the cryptocurrency for a minimum of 12 months.

- Documentation: Proper records of all transactions and holdings must be maintained to claim rebates effectively.

- Investment Limits: There are thresholds defined by the government, with rebates applicable only to amounts invested below a certain limit.

How to Claim Your Tax Rebate

Let’s break it down into simple steps to claim your tax rebate:

- Compile Records: Gather all transaction records, including purchase and sale receipts.

- Consult Tax Professionals: It’s wise to seek advice from a tax professional familiar with Vietnamese crypto laws.

- File Your Tax Return: Ensure you complete and submit the necessary tax forms to the local tax authority.

Local Market Insights: Cryptocurrency in Vietnam

The Vietnamese market is becoming a hotspot for cryptocurrency trading and a hub for new projects. The enthusiasm among retail and institutional investors is growing.

- In 2023, Vietnam reported over 6 million crypto users, accounting for approximately 7% of the total population.

- Major cities like Ho Chi Minh and Hanoi lead in crypto adoption rates.

Challenges Faced by Crypto Investors

Despite the potential for profit, crypto investors in Vietnam face several challenges:

- Regulatory Uncertainty: Ongoing changes in regulations can create confusion about compliance requirements.

- Security Risks: As evidenced by numerous hacks, the decentralized nature of cryptocurrencies poses unique security risks.

- Market Volatility: High volatility can lead to significant financial losses.

The Future of Cryptocurrency Taxation in Vietnam

Looking ahead, the future of cryptocurrency taxation in Vietnam appears bright, with ongoing discussions about creating a comprehensive regulatory framework.

- Expected Regulatory Clarity: By 2025, it’s anticipated that Vietnam will have clearer crypto regulations in place, enhancing investor confidence.

- Technology Integration: The tax authority is expected to adopt blockchain technology to streamline tax collection processes.

Conclusion

Understanding Vietnam crypto tax rebate eligibility is crucial for investors looking to optimize their tax liabilities. With the market rapidly evolving, staying informed about the latest regulations can help maximize returns and minimize risks.

As you navigate the landscape, make sure to leverage reliable platforms like bitcryptodeposit for your investing needs and consider seeking professional guidance to ensure compliance.

By being proactive and educated, you can position yourself for success in the burgeoning Vietnamese crypto market.

Author: Dr. Nguyen Minh, an experienced blockchain analyst with over 15 published papers in the field, specializing in compliance and security audits for major cryptocurrency projects.