Introduction

In the world of cryptocurrency, Bitcoin remains a revolutionary force, commanding attention for its underlying technology and intricate mining process. One of the most critical aspects of this mining process is the Bitcoin mining difficulty adjustments. As of late 2023, the Bitcoin network has seen over 18 million BTC mined, leading to a significant rise in mining challenges which prompted a need for periodic adjustments. But what does this mean for miners and the overall ecosystem? With recent studies showing that 70% of miners in Vietnam have adopted more advanced technologies, understanding these adjustments is more crucial than ever.

What Are Bitcoin Mining Difficulty Adjustments?

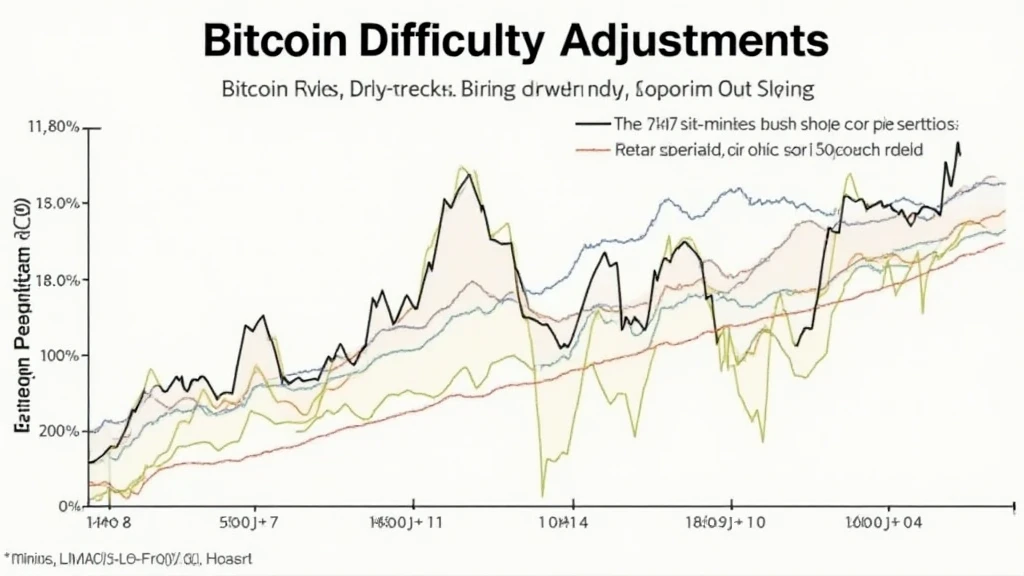

Bitcoin mining difficulty adjustments are crucial to maintaining a steady flow of new blocks added to the blockchain. The Bitcoin network recalibrates every 2016 blocks—which averages about every two weeks—to ensure that a block is mined roughly every 10 minutes. This process protects the system from excessive fluctuations in block creation, which can occur due to changes in the total computational power from miners entering or leaving the network.

The Challenge of Difficulty

- The primary purpose of difficulty adjustments is to ensure stability in transaction confirmations.

- Increasing difficulty signifies a growing interest in mining; conversely, decreasing difficulty indicates a declining miner population.

- Data from blockchain.info shows that the difficulty has adjusted by over 200% in the past year.

For instance, if numerous miners join the network, the total hash power increases, and the network must raise the difficulty to maintain the same average block time. This can create challenges for smaller miners who may find it harder to compete.

How Adjustments Impact Miners

These difficulty adjustments directly impact the profitability and sustainability of mining operations. Miners in Vietnam are reported to increase their investments in more efficient mining equipment, with a 20% growth rate observed in mining hardware sales. Here’s what miners must consider:

- Equipment Costs: Keeping up with the rising difficulty often requires upgrading to more powerful hardware.

- Energy Consumption: Increased difficulty may lead to higher operational costs due to more energy consumption.

- Profit Margins: Adjustments can squeeze or expand profit margins, significantly affecting smaller operations.

In Vietnam, where electricity prices can be a major operational cost, miners are exploring alternative energy sources, such as solar power, to mitigate their expenses. This trend highlights the necessity for adaptability in the face of changing difficulty.

Comparative Insight: Global Trends

Looking beyond Vietnam, the global landscape offers interesting insights. Factors tailored to local markets often shape how miners respond to Bitcoin mining difficulty adjustments:

- US Market: With institutional interests in Bitcoin rising, the demand for mining facilities has surged, leading to a consistent increase in difficulty.

- EU Regulations: Stricter regulations mean miners in countries like France have faced higher operational barriers, influencing their mining strategies.

For instance, as of 2023, the Bitcoin hashrate has seen a notable rise globally, attributed to the influx of institutional miners and new entrants into the market.

Local vs. Global Adjustments

Understanding how difficulty adjustments affect local miners as opposed to their global counterparts is crucial. In areas with abundant resources, such as Vietnam, miners can negotiate better rates and access to resources, affording them some protection against rising difficulty levels.

Future Outlook on Mining Difficulty

Predicting the future of Bitcoin mining difficulty adjustments involves considering various metrics:

- Market Sentiment: Prices and public perception of Bitcoin significantly influence miner participation.

- Technological Advancements: Breakthroughs in mining hardware can level the playing field.

- Ever-Changing Regulations: Regulations can either hinder or nurture mining growth.

The year 2025 promises to be a pivotal one, with analysts forecasting a potential 40% surge in mining difficulty due to increased participant engagement and technological advancements.

Conclusion

In conclusion, the Bitcoin mining difficulty adjustments are a fundamental aspect of maintaining the integrity and efficiency of the Bitcoin network. As miners, especially in regions like Vietnam, adapt to these changes, it’s essential to remain informed about the factors influencing the mining landscape. As we approach 2025, the stakes are high, making it more critical than ever to stay ahead of upcoming trends and developments. For more detailed insights and resources, visit hibt.com for comprehensive guidance on navigating the complexities of cryptocurrency mining.

Author: Dr. Alex Nguyen, a blockchain technology expert with over 15 published papers in cryptocurrency and mining technologies, has spearheaded several renowned audits in the blockchain space, providing invaluable insights into the future of digital assets.