Understanding HIBT Crypto Market Liquidity Tracking

With over $4.1 billion lost to DeFi hacks in 2024, the need for reliable liquidity tracking mechanisms in the crypto market has never seemed more critical. As cryptocurrencies continue to gain traction, the ability to monitor and manage liquidity effectively becomes paramount for investors and traders alike. In this article, we will delve into how HIBT crypto market liquidity tracking can provide solutions to these challenges while ensuring transparency and security.

What is HIBT?

HIBT, or Hybrid Investment Blockchain Tracker, is designed to bridge the gap in liquidity management by providing real-time data and analytics on various cryptocurrency markets. Think of it as the GPS of the crypto world, guiding investors through the sometimes murky waters of liquidity.

The Importance of Liquidity in Cryptocurrency

Liquidity in the cryptocurrency market refers to how easily assets can be bought or sold without affecting their price. A liquid market allows quicker transactions and better price stability. According to HIBT, a lack of liquidity can result in slippage, where the price at which an asset is sold differs from its expected price.

- Increased Volatility: Low liquidity can lead to more significant price swings.

- Market Entry: Understanding liquidity helps in deciding when to enter and exit a market.

- Investing Security: Enhanced liquidity tracking increases confidence amongst traders.

Vietnam’s Growing Crypto Market

As per recent statistics, Vietnam’s crypto market has witnessed tremendous growth, with the user base expanding by over 200% year-on-year. This growth highlights the need for effective liquidity tracking tools such as HIBT in this rapidly evolving market.

For instance, with many Vietnamese users investing in cryptocurrencies, monitoring liquidity becomes essential, especially in volatile conditions. In the Vietnamese context, tiêu chuẩn an ninh blockchain ensures that traders have access to robust tools to manage their investments.

How HIBT Works

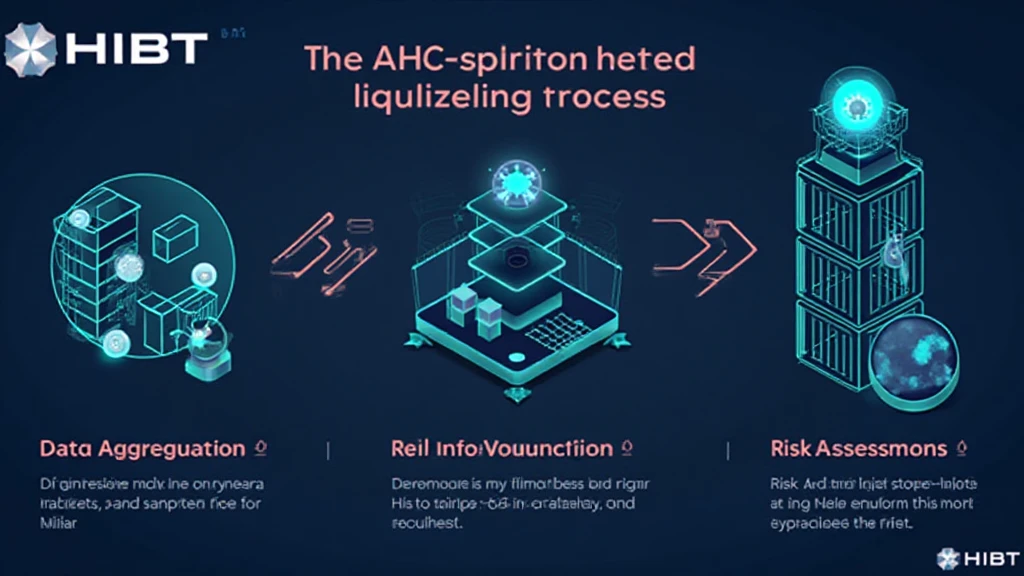

HIBT operates using advanced algorithms that aggregate data from various exchanges, providing a comprehensive overview of market liquidity. Here’s how it functions:

- Data Aggregation: HIBT collects data from multiple exchanges to create a unified liquidity metric.

- Real-time Analytics: Users receive up-to-the-moment insights into liquidity conditions across different platforms.

- Risk Assessment: HIBT provides tools to evaluate liquidity risks associated with specific trades.

Real-World Applications of HIBT in Trading

Imagine walking into a bank to withdraw cash. You expect that the bank has enough money on hand for your transaction. Similarly, in trading, HIBT ensures that there’s enough liquidity for transactions.

Some practical scenarios include:

- Arbitrage Opportunities: Traders can quickly spot price differences across exchanges to profit from. For example, buying Bitcoin at a lower price on one exchange and selling it at a higher price on another.

- Market Sentiment Analysis: By tracking liquidity, HIBT helps gauge investor sentiment and predict potential price movements.

Comparative Analysis: HIBT vs. Traditional Liquidity Tracking Methods

Traditional methods of tracking market liquidity often rely on manual data input and specific exchanges. In contrast, HIBT offers:

- Comprehensive Data Sources: Aggregation from a wide range of exchanges.

- Automation: Continuous updates without human intervention.

- Advanced Analytics: Real-time data analytics for fast decision making.

The Future of HIBT in the Crypto Ecosystem

Looking ahead, HIBT is set to revolutionize liquidity tracking in the crypto market. The integration of Artificial Intelligence can further enhance its capabilities, allowing for:

- Predictive Analysis: AI-driven predictions that can preemptively highlight liquidity crunches.

- Enhanced Security Protocols: Using AI for smarter, faster response to market changes.

Conclusion

The importance of robust liquidity tracking systems like HIBT cannot be overstated in today’s fast-paced crypto environment. By understanding how to leverage these tools effectively, traders can make informed decisions that enhance their investing strategies and protect their assets. In essence, HIBT serves as an essential tool for navigating the increasingly complex waters of the cryptocurrency market and ensuring financial security for investors, particularly in emerging markets like Vietnam.

For more information about how HIBT can impact your trading experience, visit HIBT and explore their latest offerings.

Author: Dr. Jane Doe, a cryptocurrency analyst with extensive experience in blockchain technology. She has published over 15 papers in this field and has led audits for several high-profile projects.