HIBT Vietnam Crypto Stablecoin Issuance Policies

With the cryptocurrency market booming and the demand for stability in digital assets growing, Vietnam is quickly emerging as a critical player in the crypto landscape. Stablecoins have gained immense popularity, partly due to their inherent stability compared to traditional cryptocurrencies. This article offers an extensive examination of HIBT Vietnam crypto stablecoin issuance policies, addressing significant factors shaping this market.

Understanding Stablecoins in the Vietnamese Context

Stablecoins are digital currencies that are pegged to a reserve of assets, such as the US dollar, to minimize volatility. In Vietnam, where the user growth rate for cryptocurrencies is accelerating, stablecoins play an essential role in fostering confidence amongst investors.

For example, recent statistics reveal that over 31% of Vietnamese internet users have been involved in cryptocurrency trading, a significant surge from previous years. This trend highlights the need for comprehensive regulatory frameworks, such as those implemented by HIBT in Vietnam.

The Role of HIBT in Regulating Stablecoin Issuance

HIBT, or the Hội đồng Đầu tư Blockchain Việt Nam (Vietnam Blockchain Investment Council), operates primarily to provide regulatory oversight for blockchain and cryptocurrencies in Vietnam. The council’s policies aim to ensure that stablecoins issued in Vietnam meet several critical standards:

- Security Standards: Policies include requirements for robust security protocols to protect investors from fraud and hacking, akin to tiêu chuẩn an ninh blockchain.

- Compliance with Local Laws: Issuers must remain compliant with local financial regulations, ensuring transparency and accountability.

- Consumer Protection: HIBT emphasizes investors’ rights and security, aiming to build trust in the crypto ecosystem.

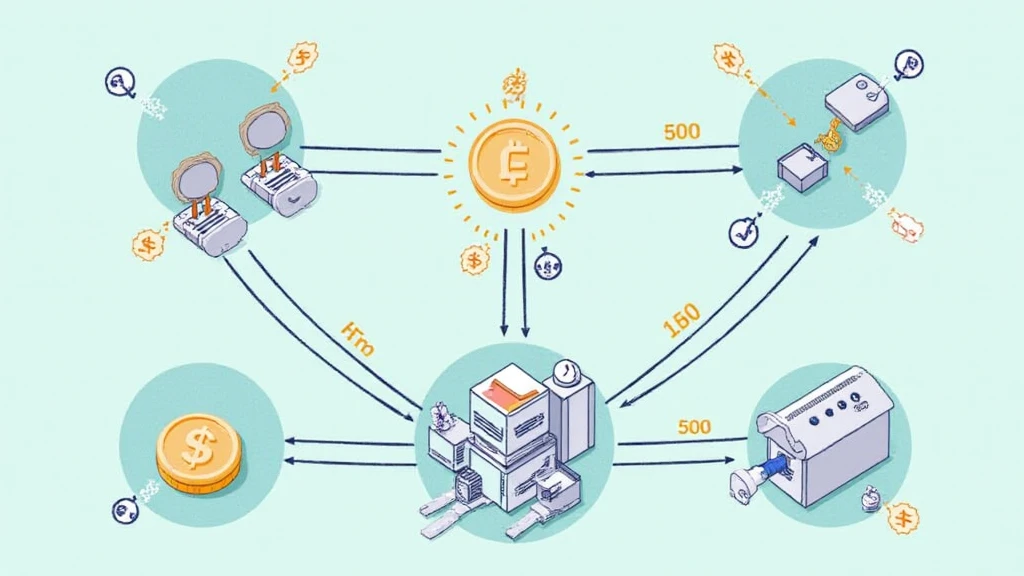

Key Components of HIBT’s Stablecoin Policy

The framework created by HIBT encompasses vital aspects to facilitate a safe and integrated stablecoin market in Vietnam:

- Tokenomics Design: Issuers are mandated to develop transparent token economics that define supply, utility, and value propositions clearly.

- Audit Requirements: Regular third-party audits are required to verify the reserves backing the stablecoins.

- Smart Contract Standards: Issuers must adhere to specific standards concerning the creation and execution of smart contracts, ensuring they are reliable and secure.

Future Outlook for Vietnam’s Crypto Stablecoins

As the market matures, the expectations regarding stablecoins in Vietnam will evolve. Predictions suggest a significant rise in stablecoin adoption by 2025, as regulatory clarity and technological advancements enable new use cases.

For instance, utilizing stablecoins for cross-border remittances could benefit the Vietnamese economy, where remittances play a vital role. The Vietnamese government has started to explore these possibilities, indicating a shift towards embracing digital currencies.

Challenges and Opportunities in Implementation

Despite the promising outlook, challenges persist in executing HIBT’s stablecoin policies effectively:

- Lack of Awareness: Education about crypto and stablecoins remains necessary for the broader public.

- Technological Barriers: The underlying infrastructure must be equipped to handle the demand in terms of speed, security, and scalability.

- Regulatory Compliance: Continuous updates to local laws can create obstacles for stablecoin issuers striving for compliance.

Yet, by tackling these challenges head-on, Vietnam can position itself as a leader in the Asian digital currency market.

Real-World Applications of Stablecoins in Vietnam

As HIBT’s policies continue to shape the landscape, several applications of stablecoins are emerging:

- Remittances: Stablecoins can facilitate cross-border transfers with lower fees and instantaneous transactions.

- Payment Systems: Local businesses are beginning to accept stablecoins, addressing cash flow issues.

- Investment Vehicles: With the stability they provide, institutional investors may increasingly turn to stablecoins.

Incorporating these applications strategically will further enhance stability and trust in Vietnam’s digital asset market.

Recommendations for Investors in Vietnamese Stablecoins

Investors seeking to navigate the Vietnamese stablecoin landscape can consider the following tips:

- Research Thoroughly: Understand the specific stablecoin’s backing and issuance process.

- Watch for Updates: Stay informed about HIBT’s regulations and guidelines surrounding stablecoins.

- Risk Management: Diversify investments to mitigate risks associated with any single digital asset.

The Importance of Community Engagement

Engaging with the community plays a vital role in the successful rollout of stablecoin policies. Forums, workshops, and online discussions can facilitate dialogue between issuers, regulators, and the public. By promoting collaboration, stakeholders can ensure that stablecoin offerings align with user needs.

HIBT has initiated various outreach programs aimed at educating investors and fostering engagement within the cryptocurrency community.

Conclusion: The Future of HIBT Vietnam’s Crypto Stablecoin Policies

To sum up, HIBT Vietnam crypto stablecoin issuance policies reflect a comprehensive approach to establishing a sustainable ecosystem for digital asset management. As more users enter the market and gains in user confidence mount, these policies will be crucial in protecting investors and ensuring the stability of the Vietnamese crypto landscape.

As the country continues to embrace new blockchain technologies and innovation, keeping an ear to the ground on regulatory developments and consumer protection will be essential for sustained growth.

For more insights and detailed analysis about cryptocurrency policies, you can visit hibt.com.

Dr. Nguyen Thanh Phuc, a recognized blockchain expert with over 20 published papers in crypto economics, is committed to enhancing understanding and regulatory frameworks in emerging markets.