Introduction: The Future of Real Estate Investment

As the real estate market continues to evolve, the integration of technology becomes increasingly vital. Did you know that in 2023, the global blockchain technology market was valued at approximately $7 billion and is projected to grow at a CAGR of around 85%? With this rapid growth, real estate investors are now seeking out innovative methods to enhance their cash flow strategies. This article delves into the powerful fusion of real estate cash flow strategy and blockchain technology, specifically tailored for platforms like bitcryptodeposit.

Understanding Real Estate Cash Flow Strategy

Before we explore how blockchain can impact real estate cash flow strategies, it’s essential to understand what a real estate cash flow strategy is. It’s all about maximizing income generated from investments, covering expenses, and ideally creating a profit. Think of it like a well-oiled machine; each component needs to work seamlessly to ensure optimal output.

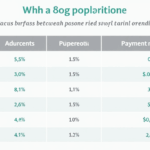

- Net Operating Income (NOI): This is the bedrock of real estate cash flow. It is calculated by subtracting operating expenses from gross rental income.

- Cap Rate: This metric helps investors assess property value and potential returns relative to its net income.

- Cash-on-Cash Return: This highlights cash flow in relation to the cash invested.

The Role of Blockchain in Enhancing Cash Flow

Here’s the catch: integrating blockchain technology can significantly improve transparency and efficiency in real estate transactions. By leveraging smart contracts, investors can ensure that cash flows are automated and secure. Imagine eliminating the need for intermediaries, reducing transaction costs, and speeding up the entire process.

Smart Contracts and Their Functionality

Smart contracts on blockchain facilitate trustless transactions. Picture this: you purchase a property using a smart contract, which outlines the terms, conditions, and payment schedule. Once the conditions are met, the transaction proceeds automatically, ensuring everyone gets what they agreed upon. This eliminates disputes and delays, leading to a smoother cash flow process.

Enhanced Liquidity Through Tokenization

Blockchain allows for the tokenization of real estate assets, transforming physical properties into digital tokens. This process enhances liquidity, making it easier for investors to buy and sell fractional ownership of properties. Here’s a quick snapshot: by tokenizing an apartment building worth $10 million, you could divide ownership into 100,000 tokens, creating a market for partial investments. This opens up opportunities to widen your investor base and generate additional cash flow.

Localizing Real Estate and the Vietnam Market

Let’s localize things a bit. Vietnam, with a booming population of approximately 98 million and a rapidly growing middle class, offers a lucrative market for real estate investment. According to statistics from hibt.com, the number of real estate transactions in Vietnam increased by over 30% in 2023. Investors must be aware of the nuances of this market, including local regulations and consumer behavior.

Incorporating blockchain can address some challenges faced by investors in Vietnam, such as:

- Transaction Transparency: Investors can access verified information, reducing the risk associated with property titles and agreements.

- Property Management: Streamlined processes for payment collections and lease agreements via blockchain-dedicated platforms.

The Benefits of a Real Estate Cash Flow Strategy Using Blockchain

Utilizing a real estate cash flow strategy integrated with blockchain technology can lead to several advantageous outcomes:

Future Trends in Real Estate Cash Flow Strategy

As we look to 2025, several trends in the blockchain space can further influence real estate cash flow strategies:

- Increased regulation around blockchain to ensure consumer protection.

- Growth of decentralized finance (DeFi) platforms that integrate with real estate.

- Continuation of blockchain education among real estate professionals, particularly in emerging markets like Vietnam.

Conclusion: Embracing the Future of Real Estate

As you explore your investment strategies, embracing a real estate cash flow strategy powered by blockchain technology can unlock new avenues of opportunity and security. With Vietnam’s real estate market on the rise, it becomes imperative for investors to stay ahead of the curve, leveraging emerging technologies. Remember, as blockchain continues to shape the future of finance, those who adapt will reap the rewards.

For more insights into maximizing your investments through innovative platforms, visit bitcryptodeposit.

Author: Dr. Alex Nguyen, a blockchain expert with over 10 years of experience in real estate investment and technology. He has authored 25 papers in the field and led notable audits of various blockchain projects.