Vietnam Blockchain Benchmark Comparisons: A Guideline for Digital Asset Growth

As the world continues to experience rapid technological advancements, the blockchain sector is rapidly evolving. In 2024 alone, a staggering $4.1 billion was lost to DeFi hacks, showcasing the urgent need for robust security standards. With Vietnam emerging as a significant player in this arena, understanding the blockchain benchmarks is critical for individuals and companies looking to thrive in the digital asset landscape.

This article serves as a comprehensive guide on Vietnam’s blockchain security standards and how they measure against international benchmarks. Also, we will touch upon essential aspects like user growth rates within the Vietnam market, explore long-tail keywords, and provide insightful tips.

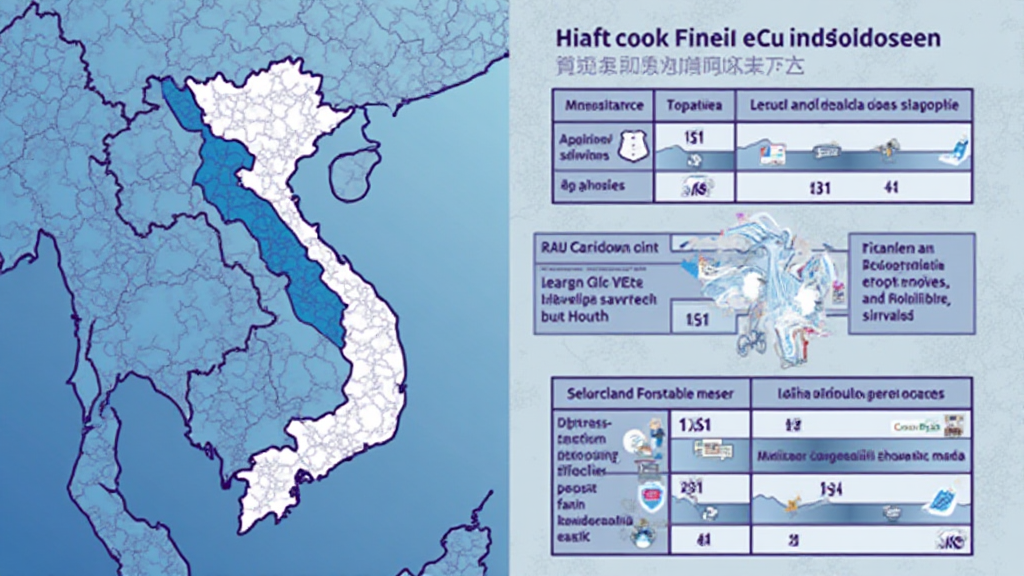

The Rise of Blockchain in Vietnam

Over the past few years, Vietnam has seen exponential growth in blockchain technology adoption. The country ranks among the top in Southeast Asia for cryptocurrency investments, witnessing a remarkable 300% growth rate in user participation over the last two years.

According to recent statistics, more than 30% of Vietnamese individuals are involved in cryptocurrency investments, reflecting a strong engagement with digital assets. This active participation creates a pressing need for clear security standards and comparative benchmarks to gauge effectiveness.

Understanding Blockchain Security Standards (tiêu chuẩn an ninh blockchain)

Security is a cornerstone of blockchain technology and one key benchmark in establishing protective measures involves understanding various consensus mechanisms and their vulnerabilities. Each consensus mechanism has its pros and cons, which we will illustrate as follows:

- Proof of Work (PoW): Widely regarded for its security but criticized for high energy consumption.

- Proof of Stake (PoS): Energy-efficient and cost-effective, yet vulnerable to a 51% attack if not implemented properly.

- Delegated Proof of Stake (DPoS): Fast transaction times but relies on a small number of validators.

- Byzantine Fault Tolerance (BFT): Provides excellent security properties; ideal for private chains.

For a country like Vietnam, understanding these mechanisms and their implications is essential, especially for developers and businesses to ensure that their platforms withstand potential attacks.

Current Security Landscape in Vietnam

As we examine the current landscape, it’s noted that Vietnam’s cryptocurrency exchanges are under scrutiny regarding security measures. Many platforms have heightened their focus on creating secure environments for transactions.

Notable players like Binance and Bitfinex have established operational standards, ensuring user trust. Going forward, the introduction of frameworks to audit smart contracts is vital.

How to Audit Smart Contracts

Auditing smart contracts involves meticulous processes, essential for ensuring safety and reliability. Here’s a step-by-step guide to conducting a smart contract audit:

- Code Review: Conduct a detailed review of the code.

- Testing: Carry out extensive testing under various conditions.

- Use Cases: Evaluate all potential use cases for vulnerabilities.

- Integration Testing: Check for compatibility with existing systems.

Adopting these practices can significantly reduce risks, thereby stimulating growth in Vietnam’s blockchain ecosystem.

The Future: 2025 Cryptocurrency Potential

Looking towards 2025, several cryptocurrencies have been identified as having significant potential. The commitment to developing a decentralized economy embodies the major shift seen in Vietnam, with projected interest increasing year on year.

Some cryptocurrencies marked for growth include:

- Ethereum (ETH): With developments focused on scalability, it remains a strong investment choice.

- Polkadot (DOT): As interoperability remains a challenge, Polkadot shines with its innovative solutions.

- Cardano (ADA): With a focus on sustainability, it presents a strong case for long-term investment.

This upward trend highlights the necessity of continued research and understanding within the blockchain community in Vietnam.

Recommendations for Vietnamese Investors

Investors in Vietnam should adopt a strategic approach:

- Education: Familiarize yourself with blockchain technology and investment practices.

- Risk Management: Understand the risks involved with each investment; consider diversification.

- Engage with Communities: Joining local groups can offer valuable insights into trends and updates.

By integrating these recommendations, investors stand to maximize their engagement in the evolving blockchain landscape.

Final Thoughts: Benchmarking Blockchain Security in Vietnam

In conclusion, as Vietnam continues to shape its blockchain future, benchmarking comparisons become vital. By laying down robust security standards, educating investors, and fostering an innovative environment, Vietnam can position itself as a leader within the global blockchain ecosystem.

Understanding such comparisons will not only pave the way for individual investor success but contribute to the overall health of the cryptocurrency market in Vietnam.

With exciting possibilities on the horizon, embracing these benchmarks through comprehensive knowledge and engagement is critical.

Explore security measures at hibt.com and consider your next steps in the vibrant blockchain world. Not financial advice. Consult local regulators for compliance.

Author: Dr. Nguyen Hoang Minh, a published researcher in blockchain technology and auditor for multiple significant projects.